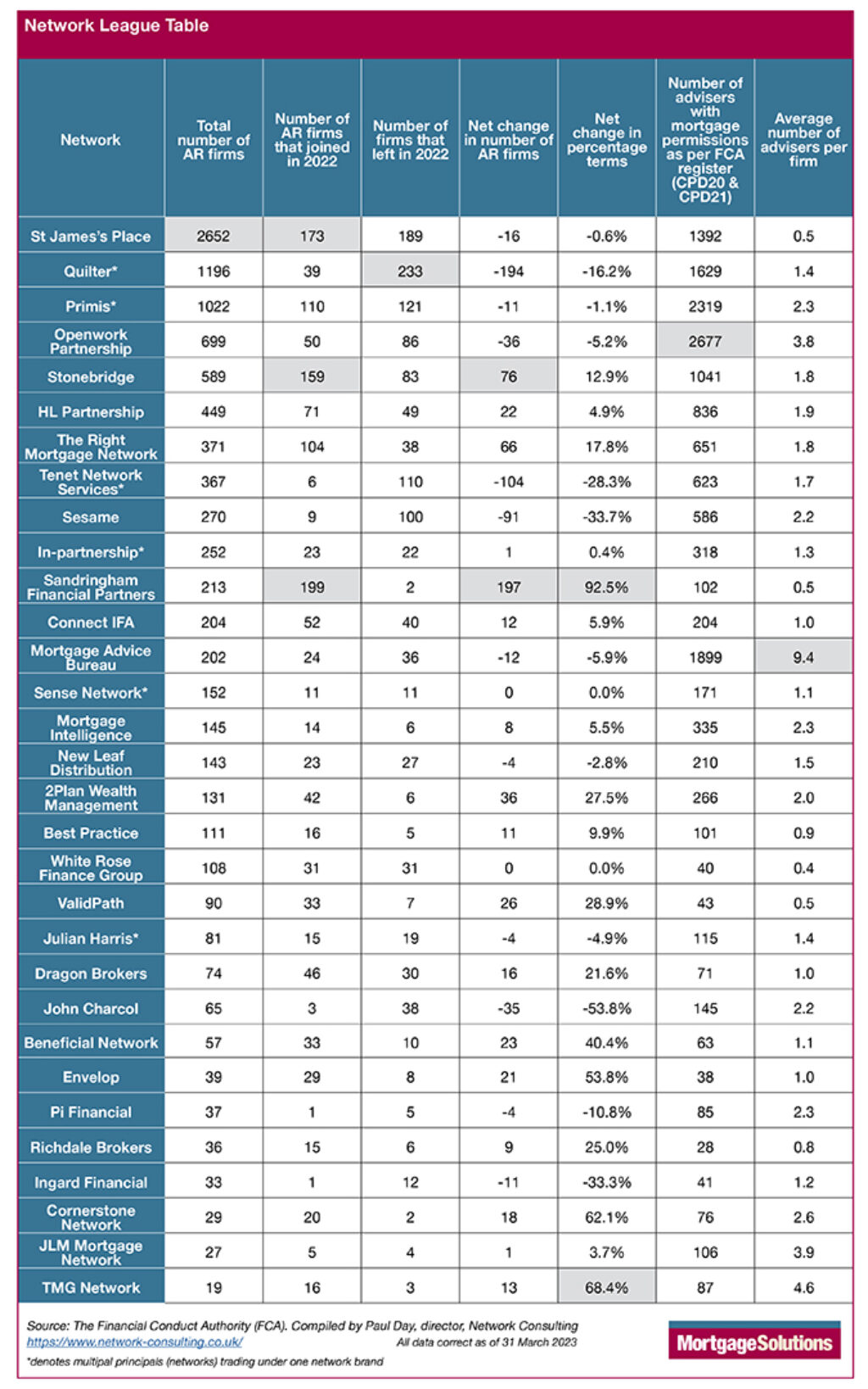

Data compiled by Paul Day, managing director of Network Consulting Services, shows how the make-up of networks has changed over 2022. The firm’s analysis is based on the FCA’s register, and the regulator’s definition of what makes a network.

The study found that Sandringham Financial Partners saw a net increase of 197 firms over the year, the largest of any network, though this appears to be largely down to its acquisition by M&G Wealth, given the majority of new ARs are dual authorised with the new parent firm.

Of regular mortgage networks, the firm to see the biggest growth over the year was Stonebridge, gaining a net 76 AR firms. As a result, it now has a total of 589 ARs, the fifth largest in the industry. It was followed by The Right Mortgage Network, which gained a net 66 firms.

At the other end of scale, Quilter saw the biggest outflow, with a net loss of 194 AR firms. Nonetheless, it is still the second largest, with a total of 1,196 AR members.

Looking at percentage gains, Day picked out TMG Mortgage Network as having an “impressive” year, after boosting numbers by 68 per cent, albeit from a low starting point.

He added: “There are also some notable positive movements in percentage terms for Cornerstone, Envelop, Beneficial, 2Plan, Validpath, Richdale and Dragon Network.”

Day also pointed to the likes of Quilter, Tenet and Sesame ‒ who all saw losses over the year ‒ who have previously said they were going through a “productivity drive” with lower producing advisers, “some of which may well have joined other firms within their respective networks”.

The full table is at the end of this article.

Providing more for members

Rob Clifford, chief executive at Stonebridge, said that it was a “tricky time” for networks. He noted that there was interest from brokers in working with networks, whether they are already an AR or directly authorised, but said that this was coming at a time when costs for networks ‒ ranging from industry fees to insurance and technology provision ‒ have been rising.

He added: “With the new AR regime and Consumer Duty, networks need more capital, to plough more profit back into provision for member firms. Now is a tricky time for networks, if they don’t have the capital or spare profit to devote to it. On the other hand, for those that are well capitalised, it could be a great 18 months.”

The Consumer Duty question

Day argued that with Consumer Duty on the horizon, networks have a big role to play for brokers, noting that a lot of work is already taking place in order to meet the changed expectations from the regulator.

He continued: “For those behind the curve in not readying themselves, possibly those in the directly authorised (DA) space that don’t have a strong principal pulling them along or a quality compliance support provider, they could be in for a rude awakening. Will it spell a shift back for some to become an AR under the relative safety of a network? Many would dispute this, but only time will tell.”

Why join a network?

You need scale in order to succeed while being directly authorised, argued Jonathan Burridge, founding adviser of We Are Money. He suggested that smaller brokers can find it difficult to build the provider relationships needed in order to provide a competitive offering, without utilising the services of a network.

Burridge’s firm is an AR of JLM, and argued that a good network gives the brokerage “autonomy, service and support, understanding that it is a service provider not an employer”.

He warned that “large corporate networks are built for the lowest common denominator”, which means they restrict activities to only cover those that represent the least risk to the network.

What makes a good network?

Austyn Johnson, founder of Mortgages for Actors, was full of praise for his firm’s network, Primis. He pointed to the work the network has done in overseeing compliance, as well as organising CPD training, as being key benefits to membership.

Picking a network is about more than just cost, argued Burridge, who said that “price is only an issue in the absence of value”. Instead it’s crucial to find a network that is a good fit for your brokerage, as well as what the process will be should you leave, noting that “often leaving a network can be complicated, slow and costly”.

Imran Hussain, director at Harmony Financial Services ‒ an AR of Stonebridge ‒ said that great networks are “few and far between”, but can offer support on everything from compliance to recruitment.

Making the move

He said it was crucial for brokers to speak with ARs from particular networks before thinking about moving, as well as “being honest with yourself around the types of clients you wish to serve prior to deciding on a network as the majority will not allow you to carry out any form of commercial, bridging or asset finance-related activities”.

Riz Malik, director of R3 Mortgages, admitted to having sleepless nights when the principal of his previous network announced their retirement.

His firm was introduced to a new network ‒ New Leaf ‒ through a friend, and praised them for making the process simple, addressing all questions and not putting Malik under pressure.

He continued: “We’ve made the switch and haven’t looked back. The assistance and support have been fantastic, and there are advantages to being part of a larger network that still knows your name.”

Network League Table

Methodology

- All figures correct as 31/03/22

- Data source – FCA register

- Adviser numbers are based on functions CPD20 & CPD21, functions for advising and arranging mortgages and equity release respectively

- Introducer ARs are excluded

- Some networks have several Principal firms in their group but trade under one brand, these are denoted by *