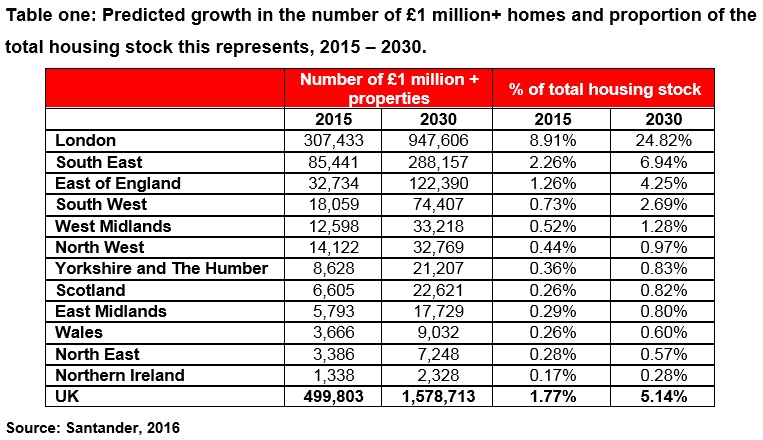

Fewer than half a million homes in the UK are currently valued at this price, which is set to rise to over 1.6m properties in the next 15 years, according to the report Property Millionaires: The Growing Housing Divide.

The largest regional increase will be seen in London, with one in four properties expected to reach the million mark by 2030 – equivalent to 947,606.

Some 7% of homes in the South East will see prices rising to this mark, but less than 1% will cost £1m or more in the North East, Yorkshire and Humber, the North West, Scotland and the East Midlands.

Professor Paul Cheshire, LSE professor of economic geography and co-author of the report, said: “By 2030 the divide between housing haves at the top and the have-nots at the bottom will be even wider than it is now. More owners will enjoy millionaire status, as homes that many would consider modest fetch seven figure prices in the most sought-after areas.”

The average UK property price, which currently stands at £283,565 is expected to increase by 97% to £557,444 by 2030.

Affordability will also decline, as the average property price is expected to rise to 9.7 times higher than the average income, a steep increase from today’s figure of 7.9 times. In London, prices will grow from the current 11.5 times income to 16.5 in the next 15 years.

Miguel Sard, managing director of mortgages, Santander UK said: “Property price inflation will tip many existing homeowners into the million pound price bracket but could also price some aspiring buyers out of the market if they don’t have the right support. The current property market is buoyant and the deals available to new and existing owners are extremely competitive, so those wishing to buy or move shouldn’t be put off.

Professor Cheshire added: “Property price inflation is beneficial for existing owners who will see their net-wealth increase, but it will make entering the market more difficult still for new buyers, further highlighting the importance of the right timing, advice, support and financial planning; and not just having a mum and dad who bought a house but a grandparent too.”