However overall transactions were largely flat, with those for purchases slipping back slightly.

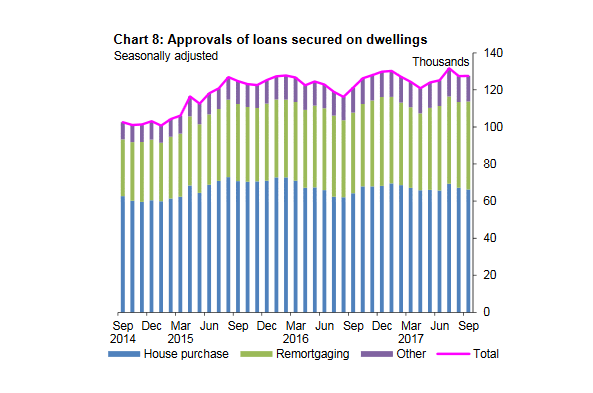

September saw 127,565 lending approvals against a dwelling, worth a total of £21.2bn – both slightly up from August totals of 127,471 for £21.0bn. (Click graph below to expand.)

Remortgaging grew to £8.4bn in 47,598 transactions (up 2.8%) from August and up 6.4% compared to the previous six months average of 44,721 transactions for £7.8bn.

However, purchase activity remained subdued at 66,232 approvals worth £12bn.

This was below the August total (67,232 transactions for £12.2bn) and previous six-month average (66,867 approvals worth £12.1bn).

Impressive resilience

Anderson Harris director Jonathan Harris was not overly concerned despite mortgage approvals falling slightly in September as they remained close to their recent average.

“The resilience of the market is impressive given the uncertainty flying around about the economy – despite higher-than-expected growth in the third quarter – and the ongoing Brexit negotiations,” he said.

“Mortgage rates have started edging up on the back of higher funding costs but lenders are still competitive and keen to lend so it is not too late for those looking for a cheap fixed rate. The remortgaging market should continue to thrive this autumn.”

Legal & General Mortgage Club director Jeremy Duncombe echoed these comments, adding: “Despite it being a slower month for lending, the mortgage market remains in a strong and robust position, even amid talk of a potential rate rise.

“Thousands of borrowers are still securing their rates now, before the Bank of England raises the base rate.”