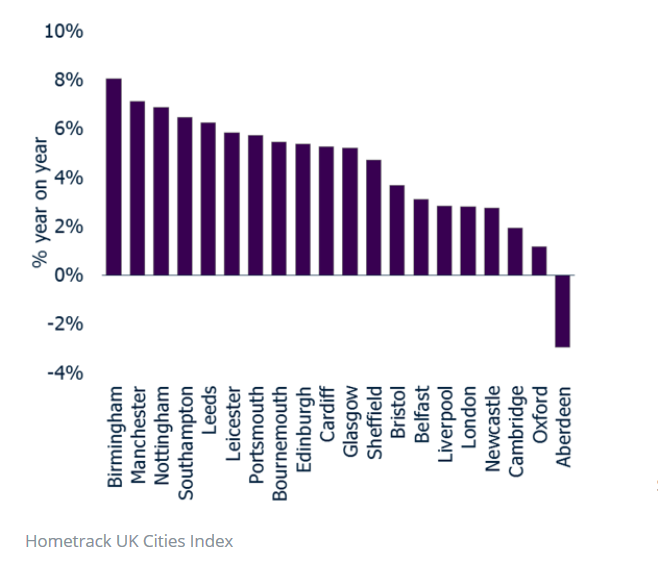

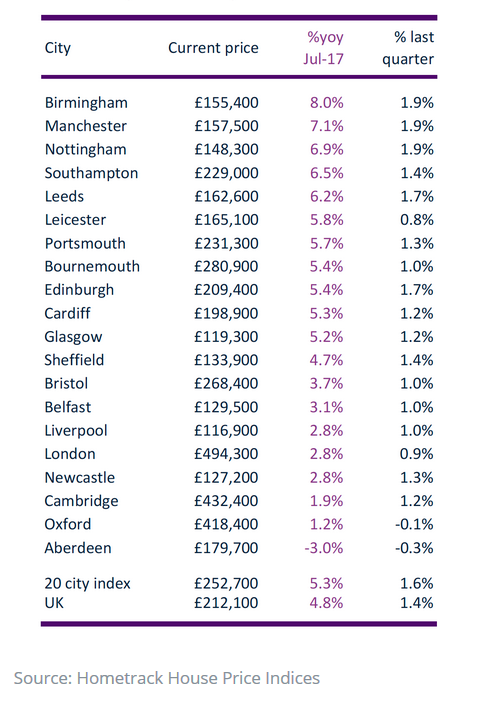

The Hometrack figure is down from the 7.4% growth at the same time last year, but is a noticeable increase following a dip earlier in 2017.

The results echo anecdotal reports from attendees to recent Mortgage Solutions Supper Club events in Birmingham and Manchester, who agreed there was an accelerating city-focused house price market.

According to the Hometrack data, Birmingham (pictured) was the fastest growing city (8.0%) followed by Manchester (7.1%) and Nottingham (6.9%), with Southampton (6.5%) and Leeds (6.2%) also rising over 6% during the last year.

It added that the steep slowdown in London house price inflation has bottomed out with an increase in the annual rate of growth to 2.8% and small price gains being recorded against the backdrop of lower turnover.

Aberdeen was the only city of the 20 highlighted to register a fall in prices (down 3%), making it two years of falling prices in the Scottish city. (Click table to expand.)

Future prospects

Future prospects

Looking ahead, it appears regional cities where affordability is better are likely to remain attractive to property buyers.

“We expect house price growth in regional cities to be sustained at current levels for the rest of 2017,” the report said.

“London is set for a sustained period of low nominal house price growth and lower sales volumes.”

This contrasted with Birmingham where “the rate of growth has been consistent over the last year and trending upwards on sustained demand, a lack of homes for sale and attractive affordability.”

London stabilisation

Price falls in London appear to have bottomed-out; after remaining static over the second half of 2016 in the wake of the Brexit vote, during the last five months they saw slow growth.

Hometrack put this stabilisation in the rate of London City house price growth down to two main factors: 1) lower transaction volumes and 2) an absence of forced sellers.

“Housing turnover across London has fallen by 17% since 2015 as affordability pressures and recent policy changes impact demand. In the absence of a jump in borrowing costs, or other adverse economic factors, sellers are slow to accept downward adjustments in prices in the face of weaker, price sensitive demand,” it said.

“The pressure on prices is greatest in the most expensive parts of London where demand has been weaker since the end of 2014. These inner London markets are registering small year-on-year price falls of up to 2%.

“The downward pricing pressure is less evident in the lowest value markets of London which have registered above average growth and price inflation of over 3%,” it added.