The survey was completed by 258 directly authorised (DA) advisers and completed in September last year.

PMS, Legal and General, Paradigm, TMA, Simplybiz and Pink emerged as the clubs used most recently by the largest number of respondents. When it came to satisfaction levels, Paradigm, TMA and Pink performed particularly strongly, but ‘competitive procuration fees’ emerged as the top reason advisers used one club over another.

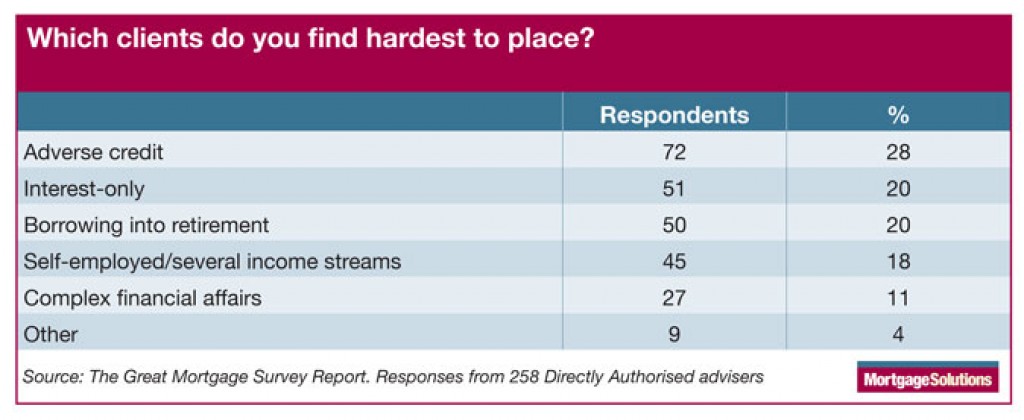

Next, the survey asked advisers to identify the ‘hardest to place’ clients. Adverse credit customers topped the list with 28% of brokers finding these the toughest consumers to place with a lender. Clients with interest-only mortgages and those attempting to borrow into retirement both emerged next, level-pegging with 20% of respondents each. Self-employed borrowers or those with several income streams emerged in fourth place, followed by those with complex financial affairs in fifth places and 4% in ‘other.’

Interest only is expected to see a resurgence this year and David Copland, director of TMA, said: “A lot of lenders are looking at both the interest-only problem and lending into retirement. This is becoming more urgent as according to ONS predictions a third of the workforce will be over fifty by 2020.”

Copland added: “Most people, lenders included, are aware that the rules around both interest only and lending into retirement need to be relaxed a little to enable people to stay in their homes on an interest-only basis – perhaps extending the mortgage to interest only for life with the capital to be repaid on death or sale of the property. This has to be better than the other alternative which is a retired person selling the property to pay off the mortgage and then spending the rest of their days in rented accommodation.”

Rising business volumes

Brokers responses over the summer last year, indicated that the massive uplift in business activity, particularly for the advice channel, clearly put smaller firms under a lot of pressure. As a result, advisers were looking at time management strategies, recruitment and marketing to exploit the opportunity.

The effects of lender’s reactions to the affordability obligations set out in the Mortgage Market Review (MMR) and resulting slowdown in processing times is a constant source of frustration for advisers, as shown by the survey. Tight criteria, affordability constraints and longer processing times acted as a slight brake on business levels, said many advisers.

However, the survey responses suggested advisers are convinced business levels will continue to improve and often refer to the enormous profile the MMR has handed the intermediary sector. Increased enquiry levels are being driven on further by the poor quality of branch advice and this new consumer understanding of the real value of advice.

Despite all the advantages the advice channel is enjoying as a result of the MMR, advisers continue to lament the extra hours it has added to the average mortgage case. Over a third of respondents, or 37%, felt the new mortgage rules added an hour to the average case, but 34%, so very similar numbers thought the figure was closer to two to three hours and 11% said three to four hours. Just 7% of brokers felt it had added over five hours legwork to the average mortgage application.

Copland said: “Mortgage clubs need to lobby and work with lenders and technology companies to find a solution to the age old problem of brokers having to come out of their client management systems and re-key data directly into the lenders’ systems. This would, however, mean moving towards a common platform which most of the large lenders are uncomfortable with as it could weaken brand values and it would take away much of the need for brokers to come on to their own websites.”

He added another way mortgage clubs can lessen the administration load for brokers is by helping to ensure the broker has the right processes in place in order to place every case and get it right first time, so their case is not rejected. All good clubs will do this by having a help desk, accessible BDMs, regular communication and by holding educational events with lenders so brokers can meet them face to face, he said.

Commission fees

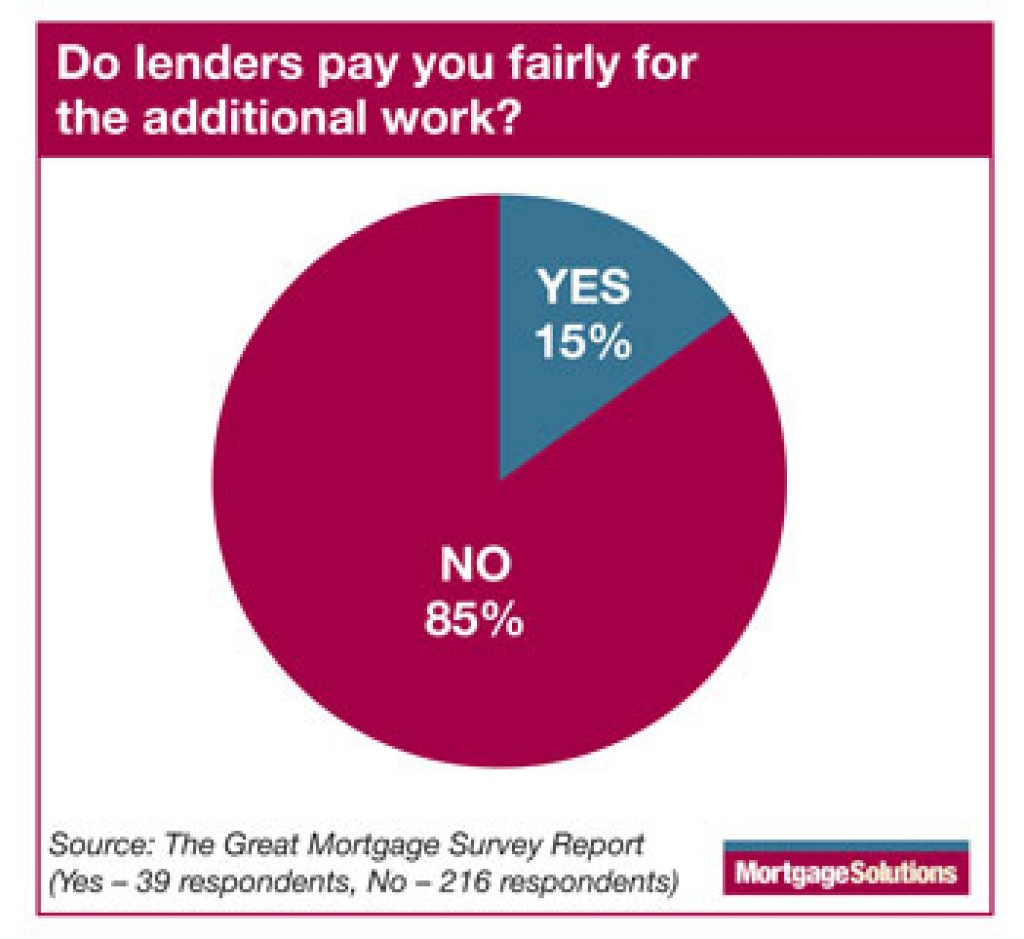

However, the vast majority of advisers agreed on one thing. A massive 85%, or 216 respondents felt intermediaries are underpaid for the work they do. Just 15% felt lenders paid brokers fairly considering the extra paperwork, checks and additional hurdles greater regulation has added to the average workload.

Copland said he doubts commission fees will move this year from 0.4 basis points (bps) for prime or 0.5 bps for specialist mortgages after last years’ hikes.

“I would prefer instead to see more lenders paying product transfer and retention fees, which is something that we at TMA have been campaigning on for some time. On top of this the broker can charge the client a fee and ensure that they always work with partners who pass on the highest level of procuration fees,” he added.

A huge thanks to all who completed the survey. The £400 of John Lewis voucher prize picked at random from respondents went out to Gary Smale, (at that time) at The Mortgage Shop in Stockport.