Despite substantial pay rises for those on or close to the National Minimum Wage, owning a home is becoming increasingly unrealistic, found Private Finance.

Meanwhile, eight job types saw home affordability drop by more than three years’ worth of salary.

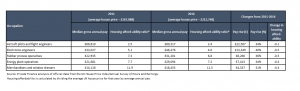

Average house prices grew by 27% between 2011 and 2016, while wages grew just 9% across all UK employees.

Analysis of official statistics by Private Finance discovered the trends in home affordability by occupation type.

As Mortgage Solutions revealed last week, Office for National Statistics data showed the extent to which the housing market in England and Wales had become out-of-reach for many over the last 20 years.

Hard hit

Bar staff were the hardest hit as they saw a negligible increase in their median gross pay and a resulting 7.3 years increase to 35 years to afford an average house. (Click graph to enlarge.)

Bar staff were the hardest hit as they saw a negligible increase in their median gross pay and a resulting 7.3 years increase to 35 years to afford an average house. (Click graph to enlarge.)

Three of the five occupations with improved affordability still needed between 6.8 years and 11.5 years of earnings to match the average UK house price.

Even the biggest increase in affordability was just half a year’s salary in two job categories – electronics engineers and rubber process operatives.

For electronic engineers in 2016 it took 4.6 years’ salary to afford the average home (down from 5.1 years in 2011) and for rubber process operatives it was 6.8 years’ salary (down from 7.3 years).

Up and away

Among the select group of jobs which had seen affordability improve, aircraft pilots and flight engineers have enjoyed the biggest five-year pay rise in cash terms of £22,507.

Among the select group of jobs which had seen affordability improve, aircraft pilots and flight engineers have enjoyed the biggest five-year pay rise in cash terms of £22,507.

As a result, the average UK house price (£212,748 in 2016) amounted to 2.4 times their gross annual earnings of £89,317, down from 2.5 times in 2011 when they earned £66,810 and the average home cost £167,888.

Electronics engineers enjoyed the greatest percentage gain (40%) in their gross annual pay over five years across all UK occupations.

Shaun Church, director at Private Finance, said: “Barring a few exceptions, even the highest earning professions have not seen their annual pay keep up and aren’t immune to the limits this can place on movement in the housing market, particularly where larger purchases are involved. This is especially true of those working in city hubs where house price rises have far exceeded the average 27% over the last five years.”