Furthermore, policymakers announced the expansion of quantitative easing (QE) by £100bn, disappointing the markets which were expecting a higher stimulus.

This means the total QE target of £745bn should be reached at the end of this year.

The MPC stated in its minutes that the fall in global and UK GDP in Q2 would be “less severe than set out in the May report”, but it would be difficult to make a “clear inference” about the recovery thereafter.

It added: “recovery in demand and output was occurring sooner and materially faster than had been expected”.

GDP fell by 10.4 per cent in the three months to April 2020, and monthly GDP fell by 20.4 per cent in April 2020, following a six per cent fall in March.

Unemployment risk

The minutes also highlighted that UK households were likely to behave cautiously despite the relaxation of Covid-19 restrictions, therefore there was a risk of unemployment being “higher and more persistent”.

Meanwhile, Office for National Statistics (ONS) data showed that inflation had fallen sharply to a four-year low from 0.8 per cent in April to 0.5 per cent in May.

This is well below the Bank of England two per cent target with the drag in inflation the result of the collapse of demand due to the pandemic.

Three years at zero

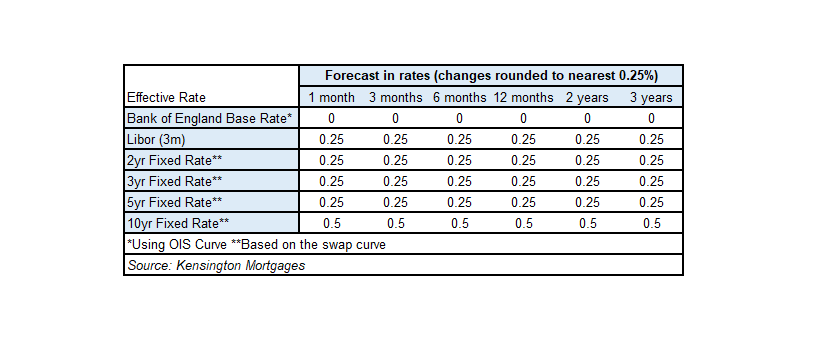

The market now expects the BoE base rate to remain at close to zero basis points (bps) for the next three years.

Interestingly, while negative rates have started to be a hot topic in the markets, governor Andrew Bailey noted that negative rates were not discussed during the MPC meeting, pushing away the talks to a further rate cut for now.

Forecasts for three-month London Inter-bank Offered Rate (Libor), two-year, three-year and five-year swap rates remain at 25bps for the next three years.

The forecast for 10-year swap rates remains at 50bps.