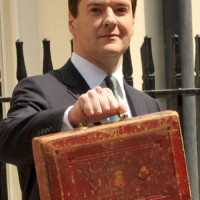

George Osborne will make his autumn statement today at 12.30. He will provide an update on the state of the economy and respond to the latest analysis from the independent Office for Budget Responsibility. There are likely to be tax implications for your clients. Here is what to look out for…

1. Capital gains tax (CGT)

“The taxation of foreigners is up for grabs again,” Bull said. Non-doms who own assets in the UK, such as a home, are not subject to CGT on the asset. The same goes for non-dom companies with property in the UK. This makes the UK unique in this aspect of real estate, and Bull predicted reform in both these areas of CGT.

2. Inheritance tax (IHT)

IHT is long overdue reform, particularly because it is seen cynically by the public as a money-grabbing tax and little else. The Office for Tax Simplification (OTS) has already recommended a full review of IHT. But Bull said IHT reform in 2012 might place too much pressure on the government amid its attempts to overhaul National Insurance (NI) reform.

3. Disguised remuneration

Since April 2011, new rules have applied preventing disguised remuneration; the distortion of pay through trusts, loans, offshore pensions or third parties to save employers’ NI and employees’ income tax. Bull said the autumn statement is likely to contain a warning that there is no way around the rules, and any schemes claiming they can circumvent them will be investigated.

4. Value added tax

Rumours of another hike in VAT have already begun to circulate. The Chancellor increased standard VAT from 17.5% to 20% in January 2011, whilst the reduced rate remains at 5%. Bull said VAT increases would be “political dynamite”, which the coalition will be wary of. However, he added the government may increase VAT now in order to raise revenues before reducing it in time for the next general election as a vote-winner.