Quarterly house price growth of just +0.1% with no monthly change in the Halifax Price index is misleading given the spike in transactions ahead of the Stamp Duty hike last year as landlords piled in before the tax changes.

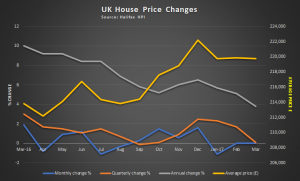

Annual growth fell to 3.8% in March from 5.1% in February. (Click graph to expand.)

Annual growth fell to 3.8% in March from 5.1% in February. (Click graph to expand.)

The average UK house price is £219,755.

Martin Ellis, Halifax housing economist, (pictured) said: “Nonetheless, the supply of both new homes and existing properties available for sale remains low.

“This, together with historically very low mortgage rates, is likely to support house price levels over the coming months.”

Halifax said mortgage approvals have been in a narrow range of between 67,000 and 70,000 a month for the last five months and the lender does not expect this level to change.

Buyers setting the tone

Jeremy Duncombe, director, Legal & General Mortgage Club, said: “March’s figures paint a similar picture to last month’s, showing a continual rise in annual house price inflation. Despite many homeowners welcoming these figures, this constant increase in house prices will fall heavily on the shoulders of aspirational homeowners, hoping to make that jump from Generation Rent into the homeownership club.”

Nicholas Finn, executive director of Garrington Property Finders, said: “No one wants to buy a home only to realise they could have got it cheaper if they had waited. As a result buyers, not sellers, are setting the tone – scrutinising prices harder than ever and refusing to overpay.

“Despite rapidly rising consumer inflation the Bank of England is likely to hold back any increase in interest rates for as long as possible, leaving the way clear for the property market to continue its sluggish progress.”