Due to end in 2021, the scheme has allowed 170,000 new homes to be built and bought in England, mainly by first-time buyers, with half saying they couldn’t have bought without the scheme.

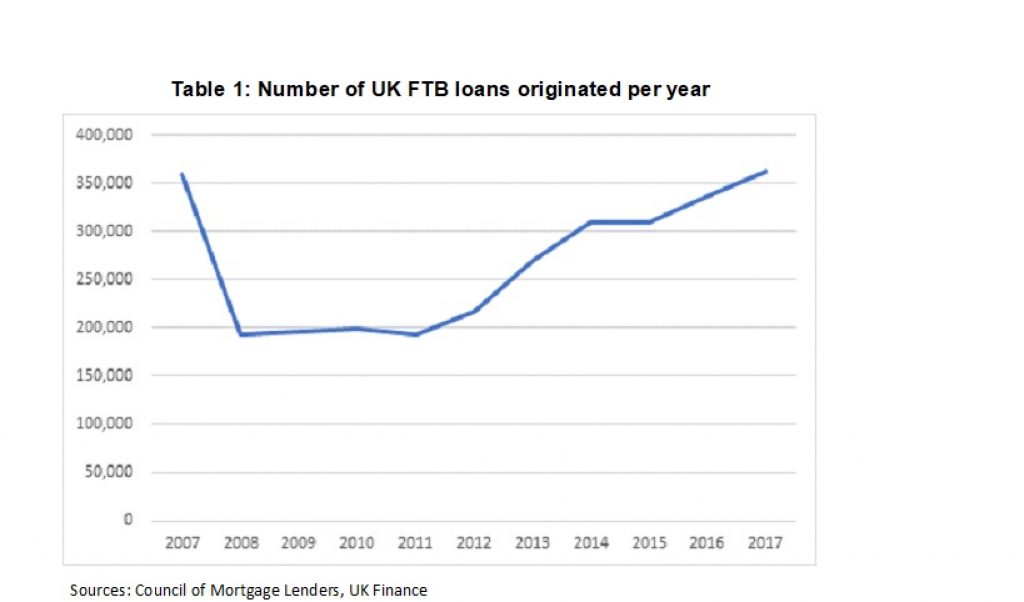

IMLA notes that this has been a major contributor to restoring UK-wide FTB lending to pre-crisis levels, with UK FTB mortgage approvals up more than a third since the scheme began.

The trade body said the government may review and curtail the scope of the scheme but warns against a policy cliff-edge that would leave many FTBs unable to secure a mortgage.

In September, IMLA outlined all its concerns in a letter to the chancellor, Philip Hammond. It was hoped that an announcement might be made at the recent Conservative Party Conference, and IMLA was pleased to note the positive reference to HTB made by the chancellor in his speech.

Kate Davies, executive director at IMLA said: “We are concerned that funding for HTB is due to be withdrawn in 2021, and that there has as yet been no clear signal as to what, if anything, might replace it.

“Lenders and borrowers place heavy reliance on the scheme, and a major step-change to arrangements would risk significant market disruption and potentially undermine the government’s ambitious targets for new housing supply.”

Davies added if changes to the scheme are being readied, lenders will need appropriate notice so they can prepare.

“We look forward to hearing the government’s plans and to working closely to continue the development of what has become a key element of housing policy,” she added.