Amid the prolonged uncertainty imposed by the latest Brexit deadline extension, now to October 31, this was in line with the markets’ expectations.

Despite stronger than expected growth in the first quarter, the MPC remains cautious and is waiting until the Brexit outcome is clearer before raising rates.

It however emphasized that markets should expect a rate rise above 0.75 per cent in the next year or so, as this would be necessary to return inflation to the 2% target at that point.

Continuing Brexit-related volatility

The MPC reiterated UK data could be unusually volatile in the near term.

It explains the recent bounce in the economy by firms bringing forward production and stockpiling goods ahead of the original Brexit departure date.

As a result, growth is expected to fall back to 0.2 per cent in the second quarter of 2019.

Regardless of a tightening labour market, the MPC pointed out that because of Brexit uncertainty, employers simply preferred hiring labour instead of making capital investments, which could lead to reduced productivity in the economy.

The committee’s neutral outlook is likely to continue throughout 2019, as inflation is expected to remain at or below two per cent over this period.

All eyes will be on the new Brexit deadline in October, and whether parliament agrees on a way forward or another extension is granted.

MPC decisions will depend on the nature and timing of the EU withdrawal but increasing inflation levels should justify Bank Rate hikes once Brexit uncertainty has disappeared.

The BoE has highlighted that its policy assumptions are based on an orderly Brexit, but that it would be prepared to take any necessary steps in a No-deal scenario.

Market expectations

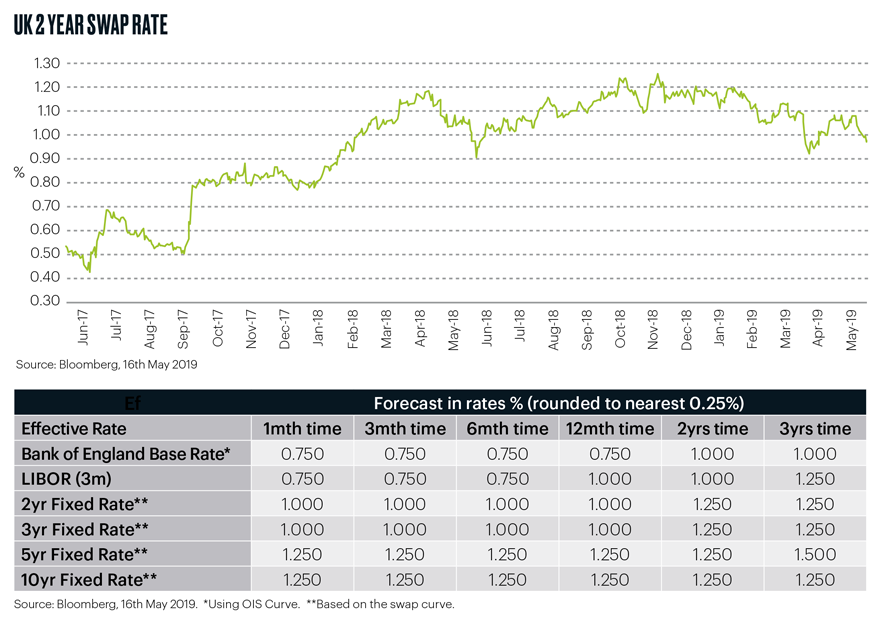

In light of these considerations, markets now forecast the BoE base rate to rise to 1 per cent in two years, and remain there for the third year.

Similarly, the three-month London Inter-bank Offered Rate (LIBOR) is now expected to remain steady at 0.75 per cent, before rising to 1 per cent in one year, and then to 1.25 per cent in three years’ time.

As the prolonged Brexit fatigue sets in, the swap markets have started to relatively price out a disorderly Brexit.

The current market prediction is that the two-year rates will stay close to 1 per cent, before rising to 1.25 per cent in two years.

Meanwhile, five-year swap rates are now expected to remain around 1.25 per cent for the next two years, before rising to 1.5 per cent in three years.

The 10-year swap rates are still expected to stay at 1.25 per cent for the next three years.

This article was written before Theresa May announced her plans today to resign as Prime Minister.