In 2018, seven in every ten people who went to StepChange for advice said the primary reason they had got into problem debt was because of a life event or shock.

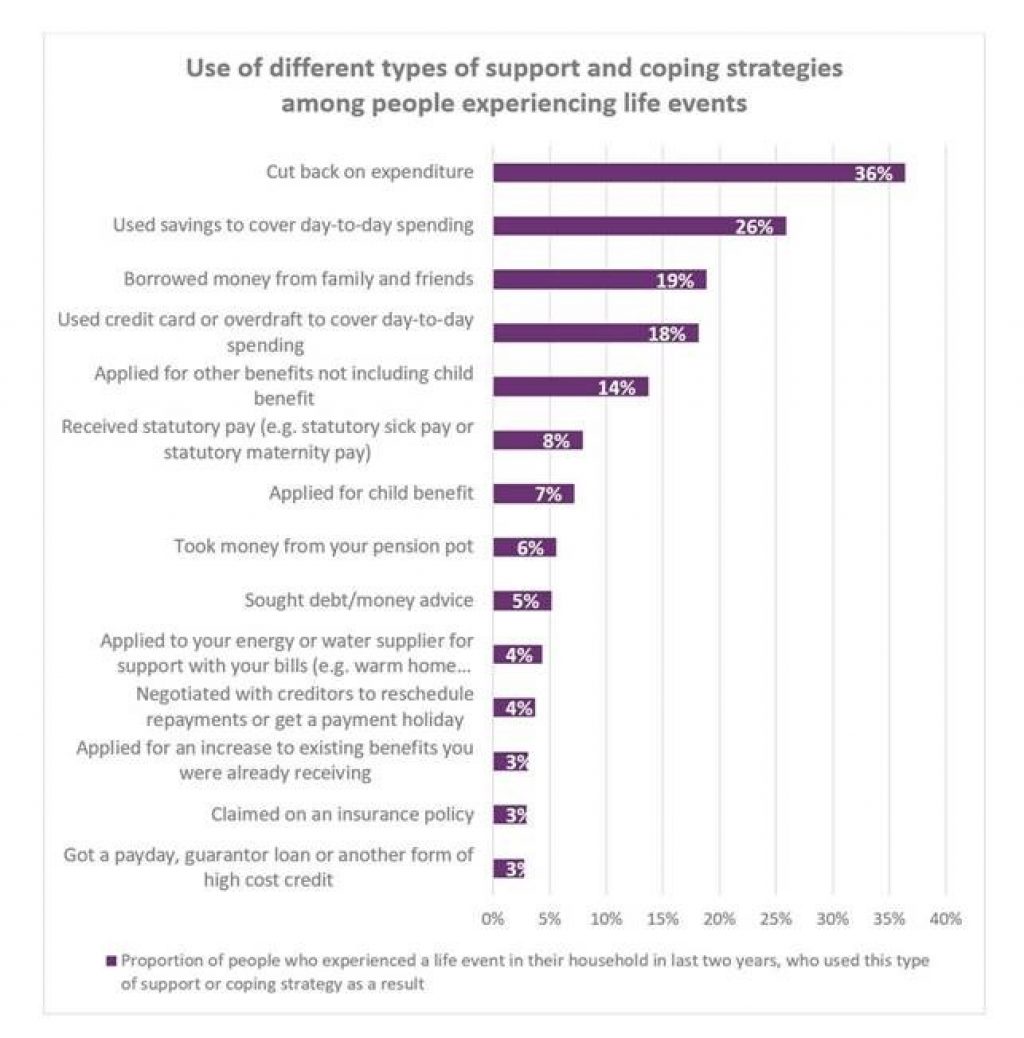

Just three per cent claimed on insurance and only five per cent sought financial advice to cope with a shock like losing their job or having hours cut, splitting-up with a partner, falling ill, or becoming a carer, the most common reasons to derail finances.

Within two years of a finance altering life event, 36 per cent of people had cut back on expenditure as a first port of call, with 26 per cent resorting to savings to cover day-to-day spending, whereas 19 per cent borrowed cash from family and friends.

On the credit management side, 18 per cent covered expenses with a credit card, but just four per cent applied to their energy or water provider to manage bill payments or apply to creditors to negotiate over or delay payments.

The debt charity observed that few people sought joined up help when life events derailed their finances.

Around 23m people have experienced a life shock in their household in the past two years.

And research from Stepchange found that people who had experienced a life event in the last two years were three times as likely to be in problem debt than those who had not.

The charity said this pointed to the need for a radical overhaul of protection mechanisms against life events, said the charity.

Stepchange CEO Phil Andrew said: “Dealing as we do with over 600,000 people a year facing financial problems, what we see being played out time and time again is that current mechanisms are just not proving effective in keeping people out of financial harm when life events do happen to them.”

He added: “The scale of the problem demands a coordinated approach. We know that many people, even those who are in work, are finding it hard to build up any level of protection against these common life shocks.

“We need policymakers to prioritise this issue and we want to work with them, and others, to identify how support can be improved to break the link between life shocks and problem debt.”

Three million people are in problem debt in Great Britain, with another 9.8m showing signs of financial distress.