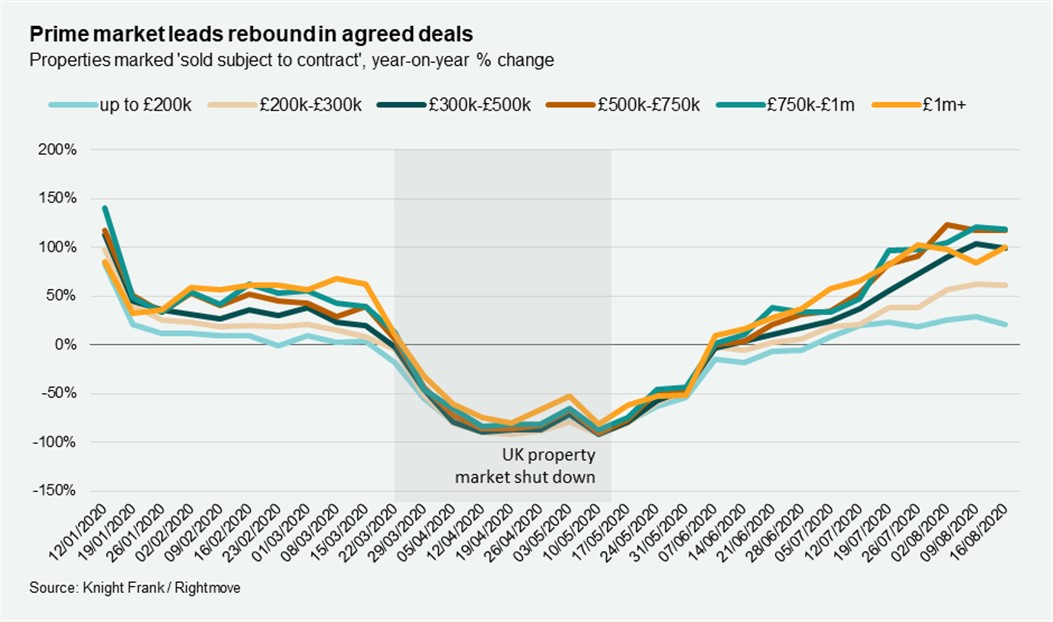

According to analysis by Knight Frank, even properties valued between £300,000 and £500,000 are now selling at double the rate as last summer.

The property market has been exceedingly busy since the government allowed it to re-open with lenders, brokers and other firms highlighting the extent of its upsurge in activity.

When examining Rightmove data of properties sold subject to contract (SSTC), Knight Frank found that properties valued £500,000 to £750,000 and from £750,000 to £1m had seen the greatest uplift in activity.

Both sectors had seen sales at around double the rate of last year since mid-July, with this reaching 119 per cent higher in the week ending 16 August.

The number of properties SSTC above £1m was 100 per cent higher than the same week in 2019, as had been the case through late July.

Meanwhile, properties in the £300,000 to £500,000 range were also selling at double the typical level for the last two weeks of data.

Small market share

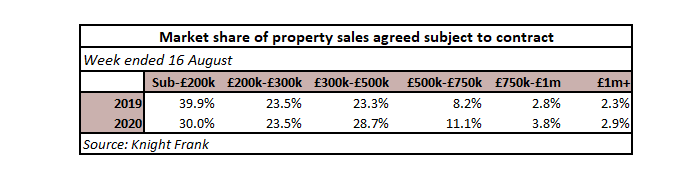

It is worth noting that the higher value sales are a much smaller proportion of the market than lower values, and so a smaller increase in numbers will result in a far greater percentage increase.

According to data from Knight Frank, in the week ending 16 August 2019, propertied valued below £200,000 accounted for 40 per cent of sales, but this year that was just 30 per cent.

Properties valued between £200,000 and £300,000 were unchanged, but those valued from £300,000 to £500,000 grew from 23 per cent of the market to 29 per cent.

Sales between £500,000 and £750,000 also saw a notable increase from eight per cent of the market to 11 per cent in 2020, while the highest to categories saw increases of around one percentage point.

However, even so, mainstream sales are up significantly during the summer, with the number of offers accepted for properties valued between £200,000 and £300,000 more than 50 per cent higher, while cheaper properties were also well above the level of last year.

Wider behavioural shifts

Oliver Knight, head of residential development research at Knight Frank said: “Such a strong rebound reflects the ongoing release of pent-up demand following lockdown, coupled with the recent cut to stamp duty.

“It is also likely that there are wider behavioural shifts in play, as people reassess their housing needs – the ‘escape to the country’ narrative is one that has been covered in detail.”

Knight continued: “A stronger recovery at the top-end reflects the fact that such buyers financial position means they tend to be able to transact more quickly, while more affluent households are also less reliant on lending.

“For now, pent-up demand, the stamp duty holiday and extension of the furlough scheme all continue to support a strong recovery in the market.”