Tag Result: Stamp Duty Land Tax (SDLT)

Stamp duty receipts pass £1bn in September – HMRC

The total intake from stamp duty land tax was £1.02bn in September, a slight dip on the �...

Stamp duty intake hits £955m in June as IHT receipts reach record high – HMRC

The amount of stamp duty land tax paid by homeowners totalled £955m in June, down on the ...

Stamp duty intake falls to £2.4bn in April and May – HMRC

The tax intake for stamp duty and annual tax on enveloped dwellings (ATED) dropped by £1....

How will the stamp duty cut impact affordability issues and market activity? – Jefferies

Although mentions of the property market were noticeably absent from the Chancellor’s Sp...

Spring Budget 2023: We need a budget for the ages not a ‘tactical response’, says tax expert

We need a budget that doesn’t meet the expectations of the market but addresses the 67m ...

This current stamp duty break is failing to invigorate the market – Bamford

What a difference a strong and functioning housing market can make.

Residential stamp duty receipts fall in Q4 2022 amid a rise in transactions

The value of stamp duty receipts fell by 12 per cent to £3.14bn from Q3 to Q4 2022, despi...

MPs vote against permanent stamp duty cut

MPs have voted against a permanent reduction to the stamp duty threshold on residential pr...

Stamp duty taxes reach record £14.7bn in year to November

Home buyers have paid £14.7bn in stamp duty so far this year, a 29 per cent jump on the t...

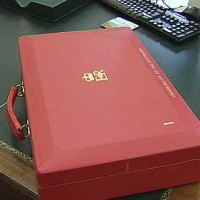

Autumn Statement 2022: Mini budget stamp duty cut now set to end in 2025

The permanent increase to the threshold for when the stamp duty land tax is paid has been ...