Hannah said: “The government needs to create a more liberal environment, less regulation, red tape and simpler tax rules. Fundamentally, The Budget must introduce and address issues that make people feel secure and feel that their disposable income is not being further eroded by the government.”

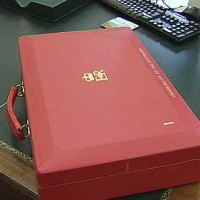

Chancellor Jeremy Hunt is under growing pressure to introduce measures to reduce inflation and public debt whilst boosting economic growth.

Plenty of measures have been pre-announced, including the boost to government spending on childcare, the introduction of 12 business zones at a cost of £80m over five years and the exention of the Energy Price Guarantee to June saving the average household £160.

However, nothing directly affecting the property or mortgage markets has been announced so far, despite hopeful calls for a streamlined Stamp Duty Land Tax regime (SDLT) or Help to Buy replica scheme.

Tax expert Hannah said one change that could be made to aid the property market is an increase in local housing allowance rates. According to the Institute for Fiscal Studies, around two million private renters rely on housing benefits or universal credit to cover their housing costs. These were last updated in March 2020 and covered the cheapest 30 per cent of properties in each local authority, but have been frozen since, with rents rising by 25 per cent on average.

“By addressing this issue, it will likely prevent a potential arrears crisis alongside providing an increase in rent for private landlords,” said Hannah.

Tax on business

Despite warnings from business leaders, Hunt is set to introduce the planned rise in corporation tax from 19 to 25 per cent from April. The corporation tax super-deduction, which allows businesses to cut their tax bill by 25p for every £1 that they invest is also set to end on March 31.

Hannah said the government needs to create a more liberal environment with less regulation, red tape and simpler tax rules.

“I think that the government needs to stop fiddling around the edges; a surcharge for this, a relief for that, a subsidiary for this – they need to get the structure of the industry, the economy, and the market right.”

He added: “There is currently a ridiculous situation where, if you start a business and do not register within the first 90 days, you’ll be issued with an automatic fine – that’s a quick way of killing a small business. There needs to be a rational approach from the government to this. Small businesses are the backbone of Britain, and I will continue to preach this – big businesses started small.”