The MPC also hinted strongly that it may consider going into negative territory for the first time in history.

Amid rising Covid-19 infections and the risk of a no-deal Brexit, the MPC minutes highlight that the Bank of England (BoE) intends to commence “structural engagements” with bank regulators in relation to the operational implications of negative rates in the next quarter.

This may mean that the BoE seeks to replicate the approach undertaken by other central banks, such as the European Central Bank and the Bank of Japan.

The MPC minutes highlighted an expected 18 per cent rise in GDP in Q3 2020, which was slightly higher than expected in the August report.

This was mainly driven by the positive high-frequency payments data which suggested that it had recovered around its start-of-year level in aggregate.

The minutes added that the level of social consumption increased partly due to the effectiveness of the government’s Eat Out to Help Out scheme launched during August.

Overall, for Q3, the BoE expects GDP to be around seven per cent below its 2019 Q4 level, which is slightly better than expected in August.

Rising unemployment, declining deflation

The MPC still expects a significant rise in unemployment to 7.5 per cent by the end of the year, which was already expected in the August report.

Surprisingly, according to the latest Office for National Statistics (ONS) numbers, the unemployment rate only rose slightly from 3.9 per cent in June to 4.1 per cent in July. However, as the furlough scheme is due to end on 31 October, we would expect this number to sharply increase.

The MPC indicated that monetary policy will remain accommodative for some time, with no policy tightening expected until inflation returns sustainably to its target of two per cent.

Recent ONS data indicates that inflation decreased from one per cent in July to 0.2 per cent in August, mainly arising from the Eat Out to Help Out scheme. The MPC expects inflation to rise to two per cent in two years’ time.

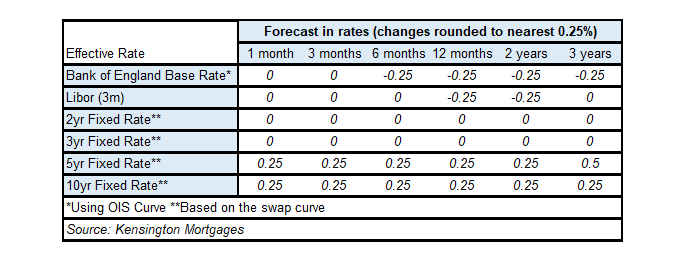

Rate expectations

With the fear of a second wave and the risk of a no-deal Brexit, the market is expecting the BoE to cut interest rates below zero in the coming months.

The market expects that the BoE base rate will fall to negative 25 basis points (bps) in the next six months and remain stagnant for the next three years. Forecasts for the three-month London Interbank Offered Rate (LIBOR) will fall to negative 25bps in 12 months and then increase to zero in two years’ time.

Two-year and three-year rates are forecast to remain at zero for the next three years, and five-year rates to remain at 25bps and increase to 50bps in three years’ time and 10-year rates to remain at 25bps for the next three years.

At this stage, given that the BoE is still considering the operational implications of negative rates for financial institutions, we can expect further stimulus for the economy via the QE program.

This may potentially occur in November due to Brexit tensions rising and tighter social restrictions in the coming weeks.

However, negative rates could still be considered at the start of next year, or sooner, if economic conditions worsen significantly by the end of 2020.

What’s happening in the UK securitisation market?

On the back of the flurry of issuances seen in June and July, where there was a total of 11 UK residential mortgage backed securities (RMBS) transactions placed raising close to £6bn of wholesale funds, primary activity in September was quieter than the previous years with only three transactions being announced.

Pepper Money placed a £280m deal collateralised by 100 per cent of second charge loans originated by the Optimum platform, Warwick 1 was refinanced into Avon Finance No.2 in a deal collateralised by £850m of legacy assets and Shawbrook Bank announced an inaugural £360m buy-to-let transaction collateralised by TML loans.

However, none of these deals have used a fully syndicated process, as did RMS32 back in July.

We continue to see a large amount of primary bonds being pre-placed this month, similar to the market dynamic observed since the pandemic begun.

Furthermore, we expect to see a lack of primary supply continue from prime issuers this quarter as they will keep taking advantage of the new Term Funding Scheme – recently launched by the government to tackle the pandemic crisis offering a borrowing rate of 10bps.