The strength of the recovery is now such that the British Chamber of Commerce (BCC) has predicted that GDP growth will soon return to pre-crisis levels.

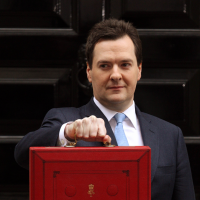

What forward guidance then will the Chancellor outline on Thursday in an effort to cement this recovery? We asked advisers what they think clients want to hear from Osborne when he makes his announcement.

ISAs

In last year’s announcement, the government unveiled plans to boost ISA, Junior ISA and Child Trust Fund (CTF) annual subscription limits in line with the consumer price index. This took the 2014-15 ISA limit to £11,880 per year, while the Junior ISA and CTF limits both increased to £3,840, from £3,720.

True Potential managing partner David Harrison is hoping for further developments on this front in order to address the long-standing problems with saving for retirement.

He said: “An increase in the ISA limit to at least £25,000 would make ISAs a viable alternative to pensions, which currently have a £50,000 annual limit. ISAs allow people to save tax-free in a way that is easy to understand and easy to arrange, but reforms to ISAs are long overdue to make them more attractive to savers.”

“As a nation we are not saving enough for our own retirements and, typically, the products that we do deposit our savings in give such poor returns that they are quickly outstripped by inflation. Many factors have combined to create a ‘savings gap’ that, at its heart, is an outdated savings structure with complicated, inflexible products.”

Pensions

Advisers have signalled that clients may benefit from fewer adjustments to the current system this year.

Carpenter Rees chartered financial planner Carl Martin said: “The Budget is bound to focus on pensions, as the government can’t seem to leave pensions alone, but it keeps missing the same point – people need to save. The push for auto-enrolment has been significant, but by continuing to limit the amount individuals can save each year, and reducing the total amount they can save into a pension before they have to pay additional tax, the public is receiving mixed messages.

“By changing the goal posts and constantly tweaking requirements every year, the government is creating more confusion for small businesses and the people who would most benefit from having these savings plans in place.”

Stamp Duty

Springtide Capital managing director Henry Knight says the government needs to address the “significant obstacle” that stamp duty currently presents to first time buyers.

He said: “While last years’ Funding for Lending and Help to Buy schemes went a long way to addressing the issue of helping struggling first time buyers onto the property ladder, we still believe that stamp duty is a significant obstacle to getting more homebuyers into their first homes. Therefore, we are hoping for an increase in the stamp duty threshold for all first time buyers up to the value of £600,000, in line with the terms of the Help to Buy scheme.”

However, there are those who warn against government intervention here, as Contractor Financial managing director and founder Tony Harris says it could undermine market confidence.

He said: “There has been much speculation that the Chancellor will seek to redistribute the burden of stamp duty in property purchase but we believe that the current system strikes the correct balance. Constant tinkering with rates and thresholds does nothing for confidence but we do feel strongly that further measures are needed to clampdown on avoidance.

“As mortgage brokers, we are approached on a weekly basis by tax specialists suggesting yet another aggressive tax planning opportunity to avoid stamp duty and I think the Chancellor needs to take further steps in this regard to ensure that all pay their fair share of tax.”

This article continues on page 2…

This article continues from page 1

Income tax

Advisers have urged the Chancellor to consider increasing the threshold of the higher rate of tax and have expressed doubts over the effectiveness of personal allowance increases.

Russell New partner Vince Mcloughlin “George Osborne should increase the threshold of the higher rate of tax. Not only does it make economic sense but it could sway voters in his direction. Many middle class earners have seen their income drawn into the 40% tax band since he became chancellor.

“With the focus having previously been on the lower end to take the lower paid out of tax, it’s actually the middle earners and hard-working families who have been hit most. Pushing up the threshold this will result in some comfort for this group.”

Equilibrium Asset Management financial planner Andy Baker says there is unlikely to be any significant changes to the 40% threshold in this Budget and that further adjustments to the income tax personal allowance amount have a limited impact.

He said: “There has been much made of the increasing number of people dragged into the 40% income tax bracket as the threshold for higher rate tax has increased more slowly than average wages for a number of years. There will not be a significant change at this Budget, but the debate is likely to continue.

“Recent discussions have also focussed on the income tax personal allowance. While making for good headlines, further personal allowance increases will make very little difference to our clients. Last year the Chancellor announced married couples could transfer an element of their personal allowance to their spouse. This appeared generous, however it only applied where one of the couple were a non-tax payer with neither a higher rate tax payer. The result was a tax saving of around £17 per month for those who met the criteria.”

Help to Buy

The overall consensus among advisers seems to be that the government’s Help to Buy scheme has been a positive contribution. In opposition to claims that the scheme is in danger of fuelling another housing bubble, advisers are adamant that the scheme is capable of delivering further benefits.

Contractor Financial’s Tony Harris said: “We hope that the Chancellor doesn’t touch Help to Buy because we don’t hold with the suggestion that this excellent initiative is inflating an asset bubble. The vast majority of Help to Buy applicants are not buying in the central London hotspots that are grabbing all of the headlines and cancelling Help to Buy would cut off a vital lifeline to the regions that need it.

Springtide Capital’s Henry Knight says borrowers would benefit from an extension to the second part of the scheme, on the understanding it adopted a more targeted approach.

He said: “We are not only hoping to see an extension of the second phase of the Help to Buy, but we are also hoping for a much more targeted approach to how the scheme is operated. In order to reduce the growing disparity between London and the rest of the country, we would like to see Help to Buy 2 operated according to the different requirements of individual postcodes.

“Some regions are more in need of a housing market boost than others, which is why we are hoping that Help to Buy by Postcode is something the Chancellor looks to include a week from today.”

SME support

The Bank of England and the Treasury launched the Funding for Lending Scheme in July 2012 in an effort to incentivise banks and building societies to boost their lending to the UK real economy. Since then, the scheme has been extended by a year and closed to mortgage lending in a bid to boost lending to the business sector.

Russell New partner Vince Mcloughlin said the strength of the recovery depends on the chancellor’s commitment to ensuring SMEs have reliable access to funding and the ability to invest in ongoing business operations.

He said: “What the government needs to do is make it easier for small and medium sized businesses to access funding to maintain the perceived growth in the economy. Improvements must be made to the Funding for Lending Scheme and we should see a commitment to a permanent increase in the Annual Investment Allowance (AIA), which allows businesses to claim capital allowances on certain purchases or investments in their business. The temporary limit of £250,000 ends in December.

“If we don’t see another increase in the Budget, then now is the time for all businesses to maximise the opportunities to use their AIA by planning the timing of their capital expenditure across the rest of this year.”

There will be full coverage of the 2014 Budget on IFAonline.co.uk on Wednesday 19 March.