The BBC reported that MPs on the All-Party Parliamentary Group on Fair Business Banking sent Lloyds Banking Group chairman, Antonio Horta-Osorio, and its chairman Lord Blackwell an open letter asking for the bank to pay fair compensation to the victims of the fraud.

Former HBOS senior manager, Lynden Scourfield, 54, of Greenford, Middlesex, was sentenced to a total of 11 years and three months for conspiracy to corrupt, fraudulent trading and money laundering at Southwark Crown Court on Thursday. The scam ran businesses into the ground and saw HBOS incur losses of £250m.

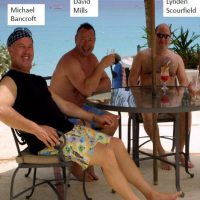

Scourfield was exposed for receiving bribes in the form of cash, holidays and sex parties in return for referring struggling customers to a corrupt consultant.

David Mills, 60, of Moreton-in-Marsh, Gloucestershire, who headed up the consultancy firm that Scourfield referred businesses in financial difficulties to, was jailed for a total of 15 years.

Mills’ wife, Alison, 51, received three-and-a-half years, with business associates Michael Bancroft, 73, and John Cartwright, 72, got 10 years and three-and-half years, respectively. Mark Dobson who also worked at HBOS and received kickbacks from Mills was imprisoned for four-and-a-half years.

George Kerevan MP, chair of the parliamentary group, wrote in the letter: “We are at a point where, once again, there are a large group of aggrieved business people who have lost their livelihoods.

“Critically, many have endured years of financial duress and personal stress.”

He went on to say that detailed complaints of the criminal actions were raised with senior managers at HBOS and were repeated in 2007 to senior members of Lloyds when it had taken over the reins. Kerevan said in both instances, there was an internal failure to adequately investigate the complaints.

“Further, police investigations were delayed because both HBOS and subsequently Lloyds informed the authorities that it was the bank that was the wronged party – rather than small business customers – but that the bank had no wish to pursue a prosecution,” he said.

The group also wants assurances the bank will review its fraud procedures and publish the findings.

At the time when the crimes took place, Lloyds did not own HBOS.