According to HSBC’s Beyond the Bricks: The Future of Home Buying report, British buyers led in the use of online channels to research, buy and finance a property.

The results prompted HSBC UK head of mortgages Tracie Pearce to warn that the process of buying a home will change beyond recognition in the coming years.

“The market may not quite be ready for robo-advice but this type of service will, in time be helpful for the financially astute borrowers who need guidance through just a few steps of the mortgage process,” she said.

“There will still be those borrowers that desire face-to-face advice, or prefer to speak with an adviser over the telephone and lenders should look to provide home buyers with a choice of channels in line with their needs and preferences.”

However, this week’s Mortgage Solutions poll found that more than 40% of brokers did not even have a website for their business.

Broker evolution

Writing in the HSBC report, digital transformation specialist James Dearsley warned that mortgage brokers and advisers would evolve to become “property technology providers and enablers”.

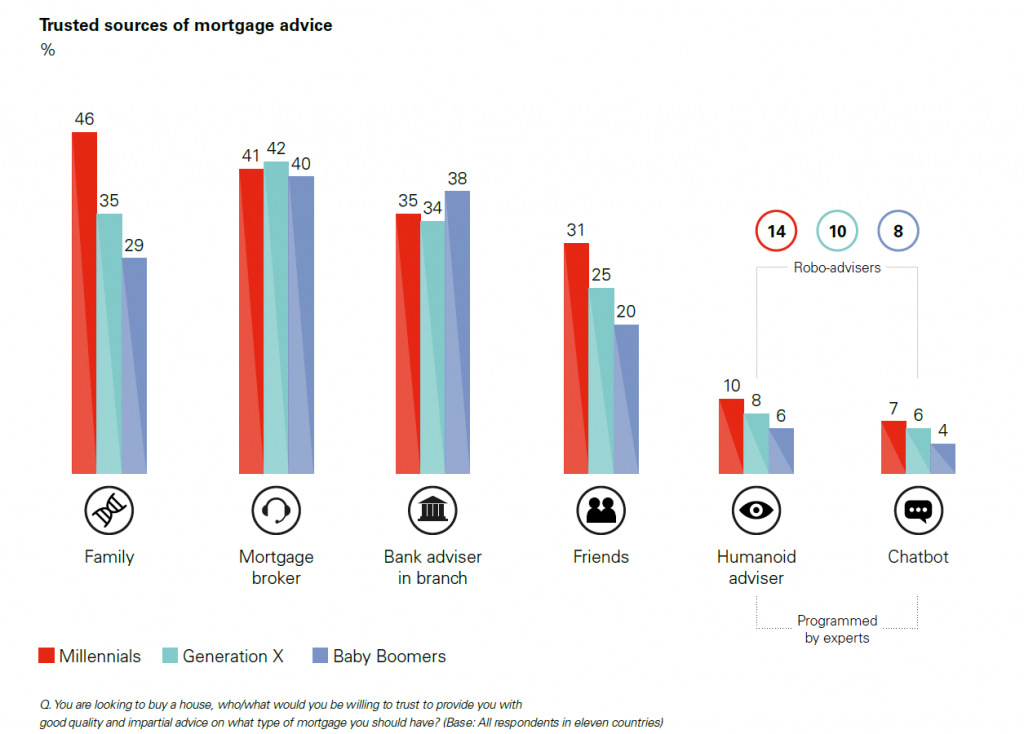

“Mortgage brokers are still the most trusted source of mortgage advice but in an increasingly time-poor society, brokers, banks and other advisers will need to offer instant service and analysis to meet the expectations of consumers,” he said.

“We can expect to see more on-demand services, retaining the important human touch but provided digitally through live chat or video. Oracle reports that 80% of brands will be using chatbots for customer interactions by 2020.

“With all of our personal information held digitally, not physically, artificial intelligence will assist by analysing personal data, assessing lending criteria and narrowing down product options. This will allow instant mortgage approvals and mortgage solutions that are much more tailored to individuals’ needs,” he added.

Global leading

The HSBC research found that the overwhelming majority of British buyers (93%) searched for property, (88%) researched finance options and (85%) identified what they could afford online – all well ahead of the respective global averages (83%, 74% and 73%).

The report, which questioned more than 9,000 people in nine countries, noted that traditional face-to-face estate agency was less influential as more than half (51%) of home buyers started talking to an estate agent online during their initial conversations.

This change should serve as a warning that mortgage advice could be the next process to move significantly online.

For example, robo-advisers are already trusted sources of mortgage information for 14% of Millennials and 10% of Generation X. (see graph below)