The Halifax House Price Index showed a monthly rise of +0.5% last month.

The average property price in the UK rose to £226,821, or 3.2% higher than £219,741 in January this year.

Russell Galley, managing director of Halifax Community Bank, said: “While the annual rate of growth eased in November, with the first decline in this measure since July, when looking at quarterly change prices in the three months to November, they were marginally higher than in the preceding three months and the fourth consecutive quarterly increase.”

He added the imbalance between supply and demand continues to support house prices, which does not look like changing in the near future.

“Further ahead, increasing affordability issues, as price increases continue to outstrip wage growth, are likely to curb housing demand and cause price growth to ease.”

Stamp duty stimulus

Although he added that he did expect the first-time buyer stamp duty cut to provide some stimulus to demand particularly in London and the South East.

Sales have remained above 100,000 every month this year, however, mortgage approvals for house purchase fell to 64,575 in October, down 2.3% from September.

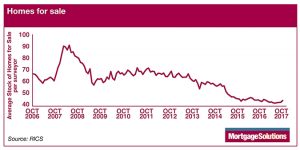

Brian Murphy, head of lending for Mortgage Advice Bureau, said: “The story of 2017 has been a lack of available properties for sale in many areas, which has created upwards pressure on prices. Of course, this is a double-edged sword; great news for the homeowner who is sat on an appreciating asset, but very difficult for those who want to get on or move up the property ladder.”

“As the Halifax report this morning indicates that the average home price of £226,821 now falls squarely within the stamp duty exception range for first-time buyers, hopefully the recent move by the chancellor will translate into real savings for those getting onto the ladder,” said Murphy.

Jeff Knight, director of marketing at Foundation Home Loans, said the stamp duty cut is predicted by the OBR to push prices up by 0.3%.

“Increased demand will certainly place upward pressure on the market – at least until reforms to the planning system start to have an effect and more land is made available for the promised thousands of new builds. However, stalled Brexit negotiations will dampen confidence as uncertainty takes its toll. This, alongside the age-old tale of weak supply, continues to subdue the market’s full growth potential.”