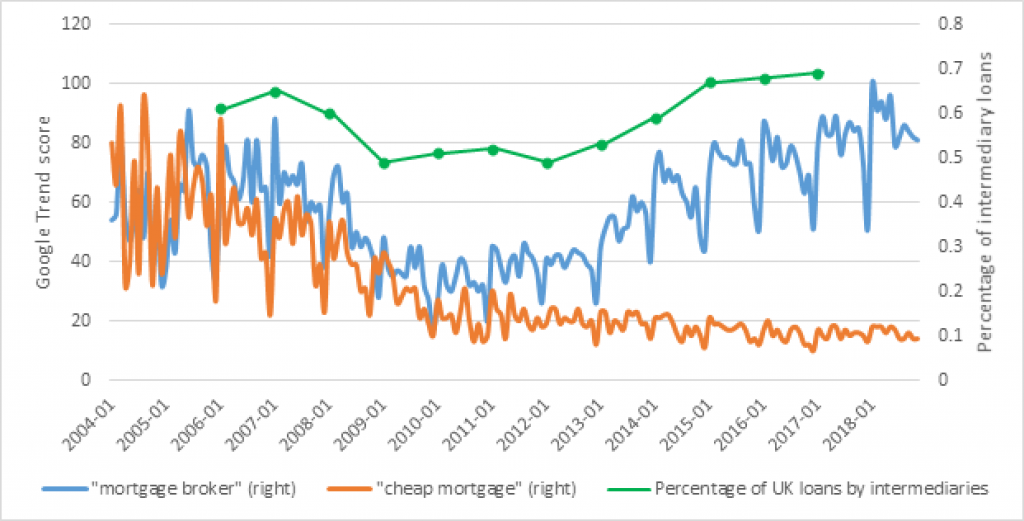

The IMLA report – ‘The technological new frontier: digitisation in the mortgage market’ – suggested examination of Google Trends (chart below) confirmed more people are looking for a broker online while fewer consumers are searching directly for the cheapest mortgage deal.

This year, the frequency the search term mortgage broker went into Google reached a 14-year high, or an increase of 180% over five years, making it more critical than ever that advisers have an online presence.

The growth in customers seeking information on mortgage brokers online has mirrored the growth of intermediary mortgage completions, where over 70% of customers now source their loan through an intermediary when changing lenders.

Expert advice

The report showed three in five customers today would prefer to speak to an adviser about complex products like mortgages, with research suggesting customers want to deal with a professional who can explain things.

This may be why IMLA’s report also supports the fact comparison websites have made limited inroads into the mortgage market, in contrast with other sectors like car and home insurance.

According to Amazon Alexa, more than half of all traffic to the top five UK price comparison websites comes through organic web searches, with cars and insurance representing the majority, but mortgage terms only accounting for 10% of all organic traffic.

The report suggested the downside of comparison websites is that they only provide customers with a list of mortgage products from different lenders based on a very limited range of criteria such as LTV and borrower type. Also, there is no certainty that customers will qualify for the loans they have selected.

Robo-mortgage broker revolution far off

While 38% of brokers see the rise of robo-advice as the biggest threat to their business in the next three years, according to L&G Mortgage Club research, there are plenty of obstacles ahead for the model to resolve.

Replicating the softer skills of a human broker, for example where the broker can appraise how well the customer understands the options on offer, will be difficult.

The report also notes that people’s lives frequently don’t fit into neat algorithms, that brokers often successfully challenge cases that are initially turned down by the lender and will also know which lenders usually offer attractive product transfers at the end of an initial deal.

Kate Davies, executive director at IMLA said: “We have already seen a number of digital advancements as the industry seeks out solutions to improve the mortgage and property transaction process. But we’re still some way from seeing a completely automated mortgage market as the technology cannot yet – and may never – fully address all customer needs.”

Davies said consumers clearly appreciate the softer skills offered by brokers, adding that online tools have made it easier for mortgage brokers to advertise their services and to be sought out by local property buyers seeking information and advice.

She said: “Advancements in Artificial Intelligence and big data capture and manipulation are allowing more of the mortgage transaction process to be digitised. I’m sure we’ll see new and exciting developments in technology and delivery – and our members are very aware of the need to keep up to speed with what the market can provide and what consumers increasingly expect, so that they can stay ahead of the curve.

On the Mortgages Market Study, Davies said constructing models which reflect the breadth of products and options across the market is very complex – and it’s clear that one size will not fit all situations.

“While we appreciate the FCA’s wish to enhance consumers’ experience, we think there is a risk that if it seeks to influence the direction of travel too strongly, it may actually inhibit the momentum which is naturally created in a competitive market.”