Mortgage brokers are set to see their regulatory fees increase by more than any other type of regulated adviser this month.

The Financial Conduct Authority (FCA) has confirmed its annual funding requirement for the 2019/2020 year, setting a budget of £558.5m to be paid for by all regulated firms.

This is an increase from £543m last year and the regulator said it would help fund its ongoing activities as well as the costs of preparing for Brexit.

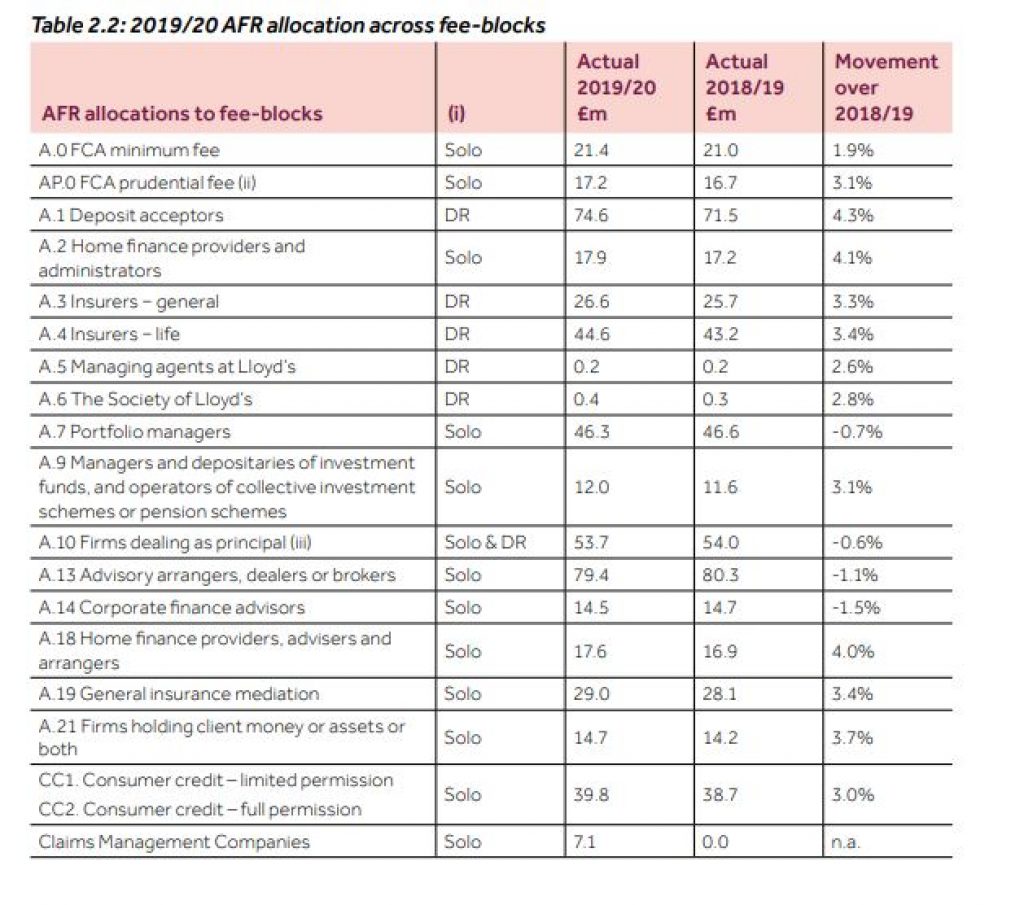

Mortgage brokers will see some of the biggest hikes after the FCA said it was increasing the amount paid by the home finance providers, advisers and arrangers fee block by four per cent to £17.6m.

In comparison, advisers in the advisory arrangers, dealers or brokers will see their bills drop by 1.1 per cent.

The minimum fee that the FCA sets for all regulated firms will also increase by 1.9 per cent to £21.4m and those conducting insurance mediation will see a 3.4 per cent increase to £29m.

The FCA’s policy statement on the changes revealed there had been opposition from an unnamed trade body for mortgage firms to the increase in fees first proposed during a consultation in April.

“A trade body representing mortgage firms was concerned about the annual escalation in mortgage related fees for a mature market which they consider does not require significant supervisory work and is working well for the vast majority of consumers,” the FCA said.

The FCA said it did not believe its fees were disproportionate.

The regulatory fee invoices are sent this month to be paid in September.