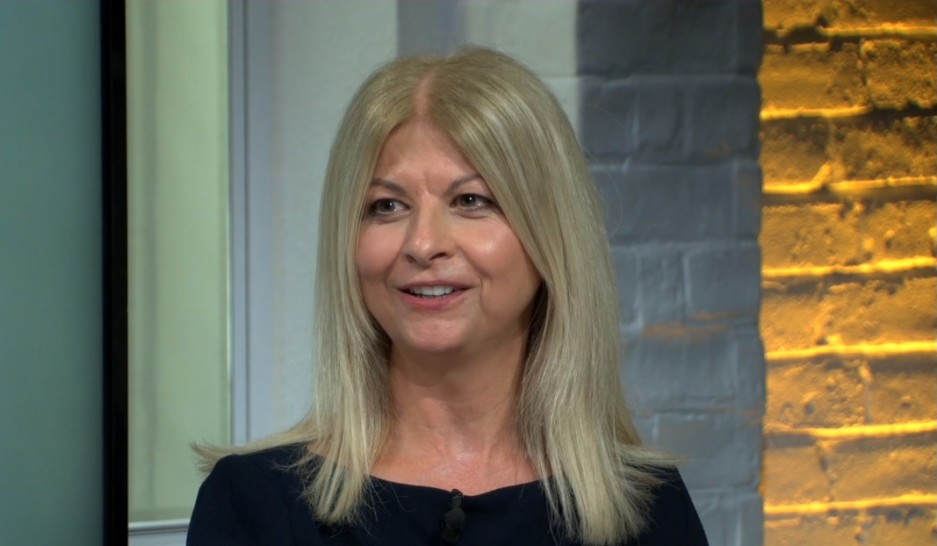

She is tasked with new customer acquisition and current customer adoption across all Mortgage Brain products.

Benjamin starts today and will be reporting into director of intermediaries, Sharon Marshall after leaving Sesame last month following a group restructure and five years with the advice group.

Neil Wyatt, sales and marketing director at Mortgage Brain, said how pleased he is that Benjamin is joining and committing to Mortgage Brain given the raft of other offers she was fielding.

He added that Benjamin would help with the challenge of drawing brokers away from submissions on mortgage lender websites.

“The previous team was focused on existing customers. This is about new users and the wider audience we can help with our technology,” he said.

“Jane’s role is to grow relationships and drive engagement in current products and those under development.

“We want to fully support brokers through our revised intermediary structure and training and making sure we onboard those customers in the way they want, whether that’s through webinar, virtual or digital assistance or video content.”

Benjamin, head of intermediary acquisition said she couldn’t wait to work with both intermediaries and lenders in the new role and was drawn to the passionate ‘people-first’ culture at Mortgage Brain.

“I love our industry and throughout all the hardship of Covid last year it has shown us once again the value of advice. So if I can work with a company that helps on the technology side, that’s the perfect solution for me,” she said.

“This role is about helping advisers find a more effective way to allow them to do their jobs for a better customer and lender outcome.”

Mortgage Brain launched Lendex, its single-log in, digital end-to-end mortgage application and submission software in mid-February. The system has four live lenders – Nationwide Building Society, Virgin Money, Coventry Building Society and Platform – with more planned this year.

The software is accessible though online sourcing solution Mortgage Brain Anywhere or client relationship management tool The Key and offers a compliance audit trail and document uploads and case tracking.