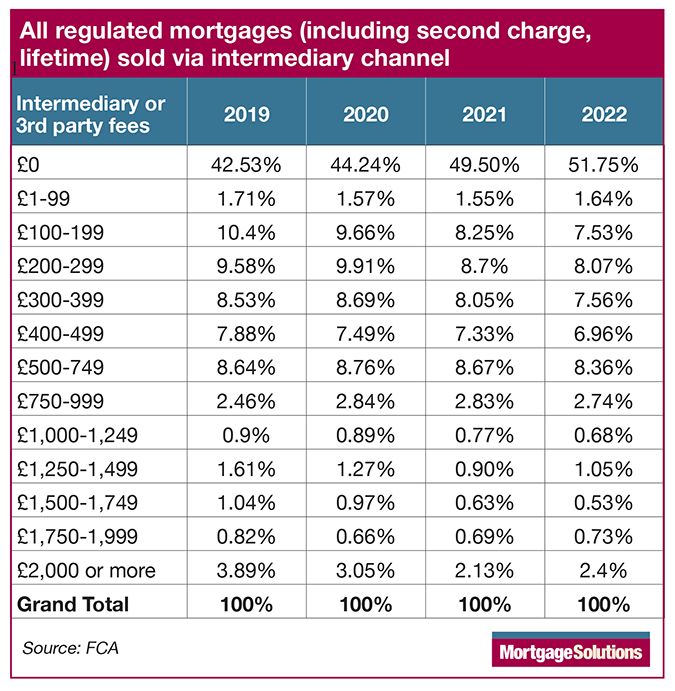

According to a Freedom of Information request sent to the Financial Conduct Authority (FCA) by this publication, around 52 per cent of all regulated mortgages sold by intermediaries are offered with no charge for the advice, including second charge and lifetime mortgages (see chart below).

Figures show that this proportion has been gradually growing over the past four years, with all regulated mortgages sold through brokers with no fee standing at 43 per cent in 2019 and for non-second charge and non-lifetime mortgages pegged at 45 per cent in the same year.

At the other end of the scale, just 5.4 per cent of brokers charged £1,000 or more in fees in 2022 for all regulated mortgages.

This has been gradually falling over the last four years, going from over eight per cent in 2019, falling to around 6.8 per cent in 2020 and then 5.12 per cent in 2021.

The number of brokers charging smaller fees of £100 to £399 has also fallen – possibly as many moved to a fee-free structure. In 2019, nearly 30 per cent of brokers charged between £100 and £399 in fees, with that figure standing at 23.2 per cent currently.

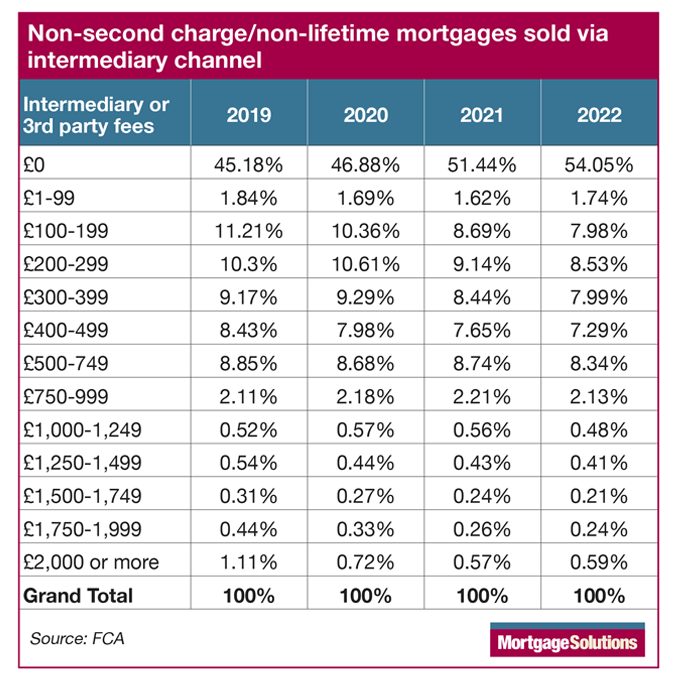

Stripping out second charges and lifetime mortgages exacerbates fee-free trend

For non-second charge and non-lifetime mortgages sold through brokers, the proportion not charging a fee rises to around 54 per cent (see chart below).

The figures for non-second charge and non-lifetime mortgages also show the proportion charging £100 to £399 has contracted with the 2019 figure pegged at 30.7 per cent and then gradually falling to just under a quarter.

The proportion of brokers charging between £499 and £999 has stayed roughly stable for the past few years at between 17 to 19 per cent for both all regulated mortgages and non-second charge and non-lifetime mortgages.

Lack of clustering “positive”

Robert Sinclair, chief executive of Association of Mortgage Intermediaries, said that it was “interesting” that there was a high proportion of loans with no fee, which is positive in some sense as they do not have to do a Consumer Duty fair value assessment.

He noted that the vast bulk of fees was under £1,000, which he said would indicate that the fees in this marketplace are “probably not” excessive.

The outliers of those that charge £1,000 would be “relatively isolated, high value cases with complex income or property types that will warrant those higher fees”. He added the deals may also have been done through private banks that do not charge a procuration fee.

Sinclair said that there was a “good spread” between the numbers and the lack of clustering was a “positive”.

“It looks like there’s either regional differences or a competitive market around that and nobody’s picking the same price, which is good,” he added.

‘Downward pressure’ on fees expected to continue

Stephanie Daley, director of partnerships at Alexander Hall, said that there had been a “downward pressure on fees to some extent” in recent years, partially due to online brokers and price comparison websites.

However, Daley warned that the level of support that a client can receive can “differ substantially” between fee-charging adviser firms, who can dedicate more time and knowledge to a case, versus a free option.

Nicholas Mendes, mortgage technical manager at John Charcol, said that current market conditions, with a fall in purchases and growth in product transfers as opposed to remortgages, fee-free applications could continue to increase in the next few years.

He noted that 2023 would be a “tough year” for broker firms, as fewer purchase applications and households tying into long-term fixed rate deals would increase competition, and in-turn, drive up the proportion of brokers charging zero fees.

Mendes added that he would expect the proportion of fees in the £500 to £749 bracket to “remain broadly the same for 2023”.

He explained that this was because larger brokerages have “larger overheads and additional staff” who support clients, and the growth in product transfers, and their lower procuration fees, meant larger fees would remain.

Fee-free mortgages show financial advice not the preserve of the affluent

David Hollingworth, associate director for communications at L&C Mortgages, one of largest fee-free brokers in the UK, said the figure suggested borrowers were increasingly opting for a fee-free approach.

However, he said there was still a “bulk” of borrowers paying as much as £1,000 in fees, with a smaller group paying even more.

“We believe that our consistent position of not charging a fee to customers, no matter how they find their way to us, is a powerful message and will ensure that advice is available to as many as possible, not just those that feel they can afford a fee,” he noted.

Hollingworth continued: “The distribution of fees suggests that some will pay substantially more than others. That could be down to the level of complexity but it also raises a question on whether some may simply be paying more than others in a more discretionary approach to fee charging.”

Alex Beavis, group director of mortgages and protection at Sesame Bankhall Group, said that the proportion of fee-free mortgages showed that “quality financial advice is not simply the preserve of the affluent and can be accessed without upfront cost, by those who need it most”.

Beavis explained: “There are many reasons an intermediary may choose to charge a fee. These can include the time costs of processing cases, which are increasingly complex and may be rekeyed several times to several lenders before completion, along with proportionate costs of running an advice business, including rising utility and premises costs, network fees, insurance, and admin support for example.”

Consumer Duty means ‘consistency’ in fees is crucial

Hollingworth said in a Consumer Duty world then it would be “increasingly important for advisers to consider whether they are charging the same fee as to any other customer and if not, why not”.

“Consistency is key and never charging a fee ensures that we offer that consistency to all our customers, whilst also broadening the availability of our advice to as many as possible,” he added.

Beavis agreed, noting that Consumer Duty placed an increased focus on fair value so brokers would need to be “prepared to show their workings on any customer charges”.

“This means being able to evidence the proportionality of fees in relation to business costs incurred and the value added to the customer,” he said.

Christine Newell, mortgages technical director at Paradigm Mortgage Services, said that Consumer Duty has put the “question on the map” whether firms currently not charging a fee could begin charging.

She explained: “Consumer Duty asks firms to consider their service proposition and create a fair-value assessment of the services they provide. This process for many firms has identified the financial costs and non-financial costs associated with obtaining and supporting new clients to achieve their goals.

“Firms are realising that to offer a fair service for all, a fee may need to be considered. What I think it will also do is create a more consistent approach to fee-charging rather than the ‘adding a fee if you can get away with it approach’ or cross-subsidising income and fees charged to some clients.”

Newell noted that “higher fees do not necessarily mean greater value” and a firm would need to be able to justify and demonstrate why their fees are a certain price.

“Consumer Duty does give them the ability to review their fee structures thoroughly and decide whether these should increase or even decrease. I think the process of assessing fair value for brokers might increase the number of firms that charge a fee and previously didn’t.”

Newell noted that with market volatility over the last 18 months, with product withdrawals, rate rises and changes in criteria, brokers were “having to work much longer hours to submit cases”.

“This certainly gives further cause for a firm to consider whether their fees are set at the right price for the work involved,” she noted.