Exclusive remortgage research from Virgin Money reveals roughly 3.2m UK borrowers are sitting on Standard Variable Rate, says Peter Rogerson, Virgin Money’s commercial director for mortgages.

The latest figures from the Bank of England show that despite some recent signs of improvement, remortgage activity across the market remains relatively muted.

The value of approvals has averaged £5.4bn per month to the end of April 2015, only slightly up on the average of £5.1bn per month across 2014. The CML also confirmed that remortgage activity among homeowners in April was down on the month and on the year.

However, new research recently commissioned by Virgin Money has shown that many mortgage customers in the UK are sitting on their lender’s Standard Variable Rate (SVR) rather than taking advantage of mortgage rates that are at an all time low, despite the significant potential savings that are available to them.

Reverting to a lender’s SVR before choosing a new mortgage deal can definitely bring some valuable flexibility for customers. There are generally no Early Repayment Charges, so customers can overpay or pay off the mortgage early and they can switch to a new deal at any point. But those who remain on SVR indefinitely are missing out on the potential benefits of remortgaging to a better deal.

Around 3.2m mortgage borrowers in the UK – representing almost one in every three loans – pay their lender’s SVR, with outstanding loan balances of almost £280bn, according to CACI data. What is interesting is that the gap between the whole of market average SVR and new mortgage rates available has continued to widen over the last year.

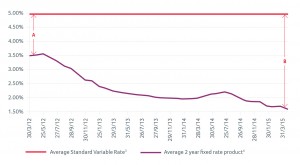

At the start of May 2015, the whole of market SVR average stood at 4.92% and the average two-year fixed rate loan was available at some 3.33% lower – see ‘B’ in the chart below. This compares to the much smaller differential that existed three years ago, when that gap was only 1.42% – see ‘A’. This offers a fantastic opportunity for intermediaries to help save their clients money.

Another interesting feature emerges when we compare consumer behaviour alongside treatment of insurance products. Our research found that while 59% of those surveyed had switched car insurance provider and 55% had switched home insurance provider within the last five years, only 3% of those surveyed that sit on their lender’s SVR had switched their mortgage provider over the same period. This is despite the significant savings available if they chose to remortgage.

Customers switching a £160k loan are able to save £3,183 per year by moving to a two-year fixed rate mortgage with an average rate of 1.59%. Those with a £250k loan could save £5,005 per year, offering a potential saving over the two year term of the fixed rate of over £10,000.

Customers looking for longer-term protection against rising interest rates could save £2,528 per year if they have a £160k loan by choosing a five-year fixed rate product with an average rate of 2.31%, or £3,985 per year with a £250k loan – offering a saving over the five year fixed rate period of almost £20,000.

This is based on a customer moving from the average whole of market SVR of 4.92% (on 30 April) to the average two-year fixed rate at 1.59%, or the average five-year fixed rate at 2.31% (1).

Despite the significant financial benefits to be had, just 14% of those we surveyed said they were likely to remortgage their home within the next year. However, if you can show SVR customers how to reduce their monthly mortgage payment, then over 50% are likely to remortgage.

For those with a mortgage balance of over £50,000 who consider themselves unlikely to remortgage, the most common factor preventing them from switching from their SVR is a lack of knowledge of the current mortgage market.

Almost 60% believed they would not find a cheaper mortgage elsewhere, another lender would not offer them a loan, or it would cost too much money to remortgage. Yet almost nine out of ten people we surveyed who said they would consider remortgaging would switch for a saving of less than £1,500 per year – a value well below the actual savings that are available to them. Despite this, many choose not to move and the research indicates that for many, there is a simple misapprehension about the basic facts associated with current mortgage pricing and the cost of moving lender.

This offers a real opportunity for intermediaries to help their clients understand the market, the potential savings to be made, and to put some money back in their pockets. It’s also a great opportunity to look at a broader financial review for clients at the same time, potentially using reduced mortgage payments to ensure clients have appropriate insurance cover in place to suit their circumstances.

To help our intermediary partners maximise the opportunity available, we have recently launched a range of new tools to support intermediaries who are looking at remortgage business, including a sales aid and letter templates for contacting clients.

For further details visit: virginmoneyforintermediaries.com

The online research, undertaken by YouGov Plc, included a sample size of 1,021 mortgage holders and was undertaken between 15 and 22 May 2015.

(1) Average interest rate for two-year (1.59%) and five-year (2.31%) fixed rate loans up to 60% LTV from the major high-street mortgage lenders at 30 April 2015, sourced from Moneyfacts Analyser Data.