As you may recall, we are exactly where we forecast we would be in our Mortgage Solutions article almost six months ago.

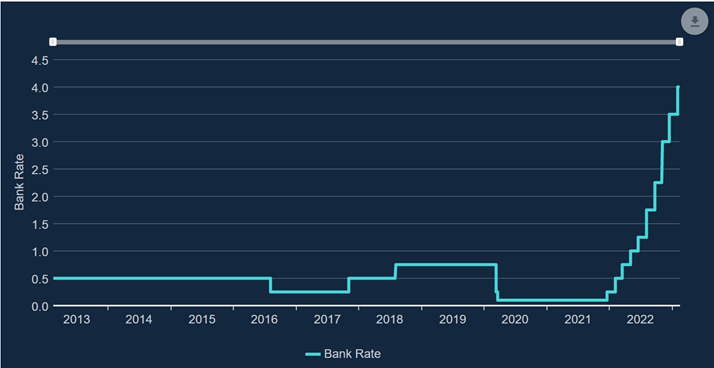

At the time, we had reported that the UK Base Rate had already begun shooting up, having already risen a massive five times in 2022 to a then level of 1.75 per cent. Since, we have seen a further four hikes in UK base rate of between 0.5 per cent and 0.75 per cent each, with the current UK base rate now resting at four per cent – see below graph, which is a level we’ve not seen since late 2008.

Source: UK Base Rate, Bank of England

Emphasis on the word ‘resting’, however, as the current level of four per cent is only temporary, just as we commented six months ago when forecasts were that UK base rate would continue to increase over the next 12 months.

The difference, however, is that six months’ ago forecasts were only for UK base rate to rise to three per cent by Q3 2023, whereas in reality we are already at four per cent and the expectation now is that we have at least one further rise of 0.5 per cent ahead of us, as we continue to wrestle with high energy price-led inflation and the Ukraine/Russia crisis.

What is happening to buy-to-let mortgages?

With higher interest rates used to control UK inflation, lenders affordability checks have similarly increased due to higher stressed interest rate assumptions.

However, in the same way as the best mortgage products disappeared when UK Base Rate began to increase – over 500 products being pulled after the UK mini Budget statement in September 2022 – so can we expect mortgage competition to increase once UK base rates peak later this year.

There is already evidence of this as mortgage lenders begin to undercut each other and we forecast this will continue, particularly with overall UK price inflation now having fallen for the third month in a row to 10.1 per cent in the year to January from 10.5 per cent in December.

Five-year UK gilt prices – a widely used reference point for five-year fixed rate mortgage products – quickly spiked to 4.67 per cent, and some forecasters expected the base rate to increase to as high as seven per cent.

Mortgage lenders were quick to respond and, almost overnight, new fixed rate products became scarce. In some instances, the industry saw mortgage rate products increase to over six per cent. However, with the ensuing change in the UK’s Prime Minister, five-year UK gilt prices quickly eased back to pre-mini Budget levels, as can be seen by the following graph.

This shows the most recent UK Base Rate rise (slowly increasing from start of February). The spike in the past few days is the lead up to the inflation numbers, now they have come out and are starting to show a reduction the five-year gilt yield continues to reduce:

Source: Five-year UK gilts

Looking to the future

Monetary policy will continue to be used to control UK inflation but, once inflationary pressure eases and high interest rates start to impact economic growth, so interest rates will come down.

Mortgage competition will undoubtedly return, as with all cycles, but keep yourselves strapped in for a little longer while the bumpy ride continues.