Richard Campo (pictured), founder of broker firm Rose Capital Partners said mortgage rates have “bottomed out”, pointing to “interesting movements in the money markets over the past week”.

He explained that this was “fuelled by the sentiment that interest rates haven’t yet topped out in this cycle”.

“This is going to have an impact on the pricing of fixed rate mortgages,” Campo added.

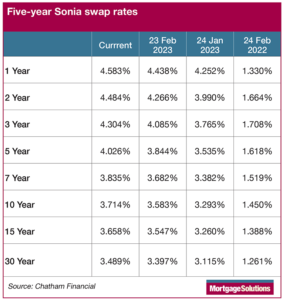

He expects the base rate to go up potentially twice in 2023 and noted that five-year Sonia swap rates were above four per cent for the first time in months.

Campo said this was up by five per cent in the past few days and 14 per cent overall in the past month.

“I believe that five-year fixed rates will not fall to the predicted 3.5 per cent by H1 2023. This is very different to what has been predicted of late. We may now be seeing the end of falling mortgage rates,” he said.

Campo said if the base rate rises, which he expects, then the current batch of sub-four per cent five-year fixed rates will be the “cheapest we’ll see in a while”.

He continued that in the “long run”, five-year fixed rates would settle at four to 4.5 per cent and this would “become the new norm”.

“Some lenders in the past week have thrown in all their chips in an attempt to secure new business by launching 3.75 per cent five-year fixed rates.

“They are now drowning in applications which they can’t process – a sure indication that they are keen to sign up the business before they have to start raising rates or pulling products, which some have already started to do,” Campo added.

He urged those looking to take a new fixed rate product with a rate that’s close to four per cent or below “should act now to secure it”.

“As always, we don’t have a crystal ball, so this is what I am suggesting from my reading of the money markets. But, unless something changes, geopolitically or economically, I feel that, even if base rate settles at four per cent, then a five-year fixed rate at around four per cent looks exceptional value,” Campo said.

“The rate you will be offered will depend on your personal circumstances, deposit and income. Therefore, advice should be sought before acting.”