A quarter of all construction work in February was for private new builds, which marked a 1.5% rise on January, and a 7.6% rise on February 2017.

However, overall construction output fell 3.0% in February compared to the same month in 2017 – the biggest annual fall since March 2013, the Office for National Statistics (ONS) reported.

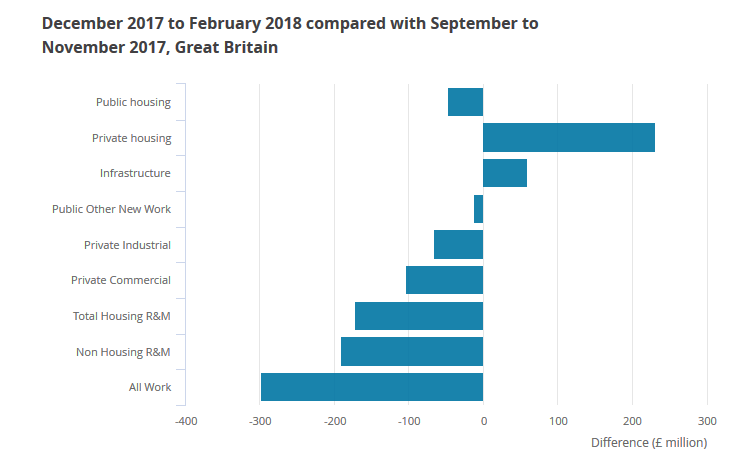

And on the three-month rolling measure it fell 0.8% in December 2017 to February 2018 compared to the previous three months, the fourth consecutive decline.

Private housing and infrastructure development were the only elements of the sector to provide positive contributions – with infrastructure accounting for a £60m increase over the three months. (Click graph to expand.)

The ONS suggested the bad weather could have potentially contributed to the decline in construction output, but added that it was difficult to quantify the exact impact on the industry.

Fewer bright spots

Naismiths managing director Blane Perrotton was sceptical of this argument, noting that only so much of February’s slowdown can be explained away by the icy weather.

“The bright spots are getting fewer and further between. Housebuilders continue to shine as low interest rates and a chronic shortage of homes keep demand burning bright,” he said.

“Infrastructure too offers some hope, with London’s three flagship projects – the Thames Tideway Tunnel, Heathrow Q6 and Crossrail – together committing to more than £1.7bn of capital expenditure in 2018-19.

“But these strong points are increasingly looking like outliers, as commercial property demand cools and developers concentrate on completing existing projects rather than commissioning new ones,” he added.

Spicerhaart part exchange and assisted move business development director Neil Knight noted that the government’s focus on new housing was starting to pay dividends.

“While we are nowhere near producing the level of new housing we need to keep up with demand, we are moving in the right direction. I just hope that this trend continues,” he added.