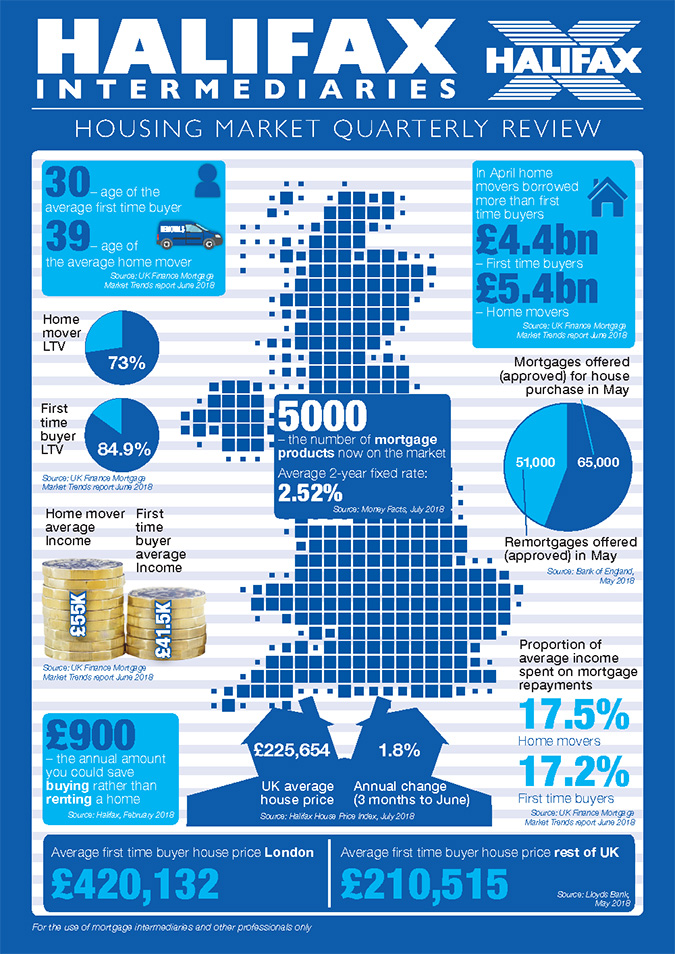

The lender compiled figures (below) from across the mortgage industry to identify some of the key trends driving the residential market during the second quarter of the year.

It also highlighted that income and deposit requirements were often steep but with the average loan-to-value (LTV) of a first-time buyer mortgage at 85%, they were succeeding.

Ian Wilson (pictured), head of Halifax Intermediaries, said: “We know there are significant barriers to homeownership, borne out by these stats, with the average first-time buyer property price at £210,000 and their typical income just over £40,000.

“But despite the challenges, it is fascinating that first-time buyers find a way – whether that is through a government scheme such as Help to Buy, parental support, or waiting until they are older and have greater buying power.

“As we can see they are typically putting down 15% of the property price as a deposit – that’s over £30,000 on average.”

Good mortgage affordability

Wilson also noted that once a deposit had been raised, mortgage spending was similar between first-time buyers and existing homemovers – and that savings compared to paying rent could be substantial.

“Many of these aspiring homeowners recognise that if they can get over the deposit barrier (even if they need a leg up), the cost of servicing a mortgage is typically less than renting – £900 a year less according to Halifax’s own research,” he said.

“And of course, they get all the other benefits of homeownership too.

“These stats give us the average figures but we also know that first-time buyers are a more diverse group than ever before.

“It is often because of the expert advice of their mortgage broker, combined with products tailored to their needs, that they are able to make that first step onto the housing ladder,” he added.