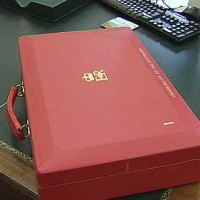

The chancellor said he will “do whatever it takes to support the economy” in the face of the outbreak, as he unveiled £30bn of stimulus measures to support businesses, as well as splashing government cash to take public investment to the highest level since 1955.

There is a likely to be a temporary disruption to the economy from coronavirus, with a fifth of workers off at any one time, and for a period it is “going to be tough,” Sunak said.

But he added that “life will return to normal” and “we will get through this coronavirus together”.

He set out a three-point plan in response to the coronavirus outbreak.

First, any extra resources needed by the NHS will be granted.

Second, statutory sick pay will be available to anyone asked to self-isolate, while self-employed people will be able to access benefits quicker and easier.

There will also be £500m hardship fund for local authorities that can use the money to support vulnerable people.

Third, businesses with less than 250 employees will be able to get a refund on paying statutory sick pay to employees for up to 14 days.

A £3,000 cash grant is available for firms eligible for small business rate relief to help them deal with coronavirus interruption.

And rates for small businesses in the leisure, retail and hospitality sectors will be abolished for a year.

Housing

A new stamp duty surcharge on non-UK residents at a rate of two per cent from 2021 will be introduced.

The chancellor pledged to extend the affordable homes programme with an extra £12bn.

Sunak confirmed £650m to help rough sleepers into permanent accommodation.

He created a building safety fund worth £1bn – to remove all unsafe combustible cladding on buildings above 18 metres high.

He also said there will be planning reforms set out this week, and that there will be consequences for local authorities which miss their targets.

A digital identification project has also been announced to help simplify the home buying process.

And the remaining £8bn of Bradford & Bingley and NRAM mortgage books are expected to be sold off this year.

Economic forecasts

Without accounting for the impact of coronavirus, the Office for Budget Responsibility has forecast UK growth of 1.1 per cent in 2020 and 1.8 per cent in 2021.

The chancellor said the Budget was delivered within fiscal rules detailed in the Conservative manifesto.

Tax changes

The National Insurance threshold for employees and self-employed is set to rise from £8,632 to £9,500 in April.

The ‘tampon tax’ has been abolished, meaning there will be no VAT on women’s sanitary products from 2021.

There will be £1m of support to promote Scottish food and drink overseas.

And the business rates discount for pubs has been increased from £1,000 of £5,000. The planned rise in beer and alcohol duties have been cancelled.

Fuel duty has also been frozen.

VAT on digital books and magazines – the so-called reading tax – has also been scrapped.

The immigration health surcharge has been increased to £624.

And the chancellor also announced £6bn of new funding to support the NHS in this parliament.

Business boosts

The chancellor has pledged £130m of funding to extend start-up loans and £200m for life sciences.

At the same time, entrepreneurs relief will be reformed. The lifetime allowance has been cut from £10m to £1m.

Research and Development (R&D) investment has been increased to £22bn a year.

Taxes on pollution

The chancellor increased taxes on pollution.

From April 2022 the levy on electricity is to be frozen and will be raised on gas.

There will also be a new plastics packaging tax with manufacturers paying £200 per tonne on packaging less than 30 per cent.

Tax relief for red diesel has been abolished for most sectors.

The chancellor pledged £120m for flood defences and a £640m nature for climate fund

There will be £800m invested to create two more carbon capture clusters.

Getting Britain building

The chancellor said £600bn will be made available for building over the next five years – the course of parliament.

There will be £27bn put towards strategic investment in roads and motorways, and £2.5bn to fix potholes.

Sunak said 4G will cover 95 per cent of the country over the next five years.

There will also be £500m available to support the rollout of charging hubs for electric cars.