According to the Charter, from 10 July, customers approaching the end of a fixed rate deal would have the chance to lock in a deal up to six months ahead.

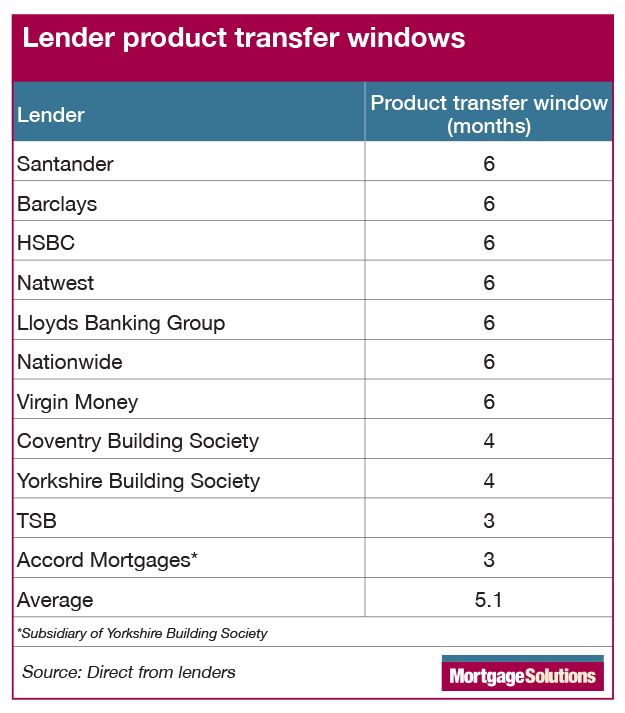

A poll of the top 10 lenders by Mortgage Solutions showed that while the majority offer six-month windows for product transfers, 36 per cent do not. Coventry Building Society and Yorkshire Building Society offer a four-month window for product transfers with TSB offering three months.

The Mortgage Charter, which 90 per cent of the mortgage lending market signed, is a government-lender initiative which has a raft of measures lenders should follow to support customers during this volatile financial environment.

Brokers have said that by and large, with the exception of Santander who extended their window on the 25 July from four months to six months across all channels, and Virgin Money who extended their timeframe from four to six months last week, most have maintained their current timeframes, which has led to confusion and frustration from customers.

A TSB spokesperson said that three months was within the Mortgage Charter rules, which mandates that customers approaching the end of a fixed rate deal will have the chance to lock in a deal ‘up to six months ahead’.

A Coventry Building Society spokesperson said that it would allow product transfers to be booked four months in advance and allow customers to change the product up until the 23rd of the month before the new deal starts.

They added: “This meets the conditions of The Mortgage Charter. However, given the economic backdrop, we will keep this under review and would advise borrowers to check our website for any update.”

Jeremy Duncombe, managing director of Accord Mortgages, said that it was supporting the requirements of the Mortgage Charter and its teams were “prepared, as always, to offer as much support as possible to customers facing difficulties in meeting their mortgage payments”.

He continued: “After careful consideration, we have retained our existing product transfer window of three months within our Accord intermediary lending business for operational reasons, to ensure fast implementation of the Charter requirements, with our priority being to provide customers with the flexibility they need as quickly as possible.”

Lender reluctance ‘disappointing’

HomeOwners Alliance’s director Angela Kerr said that it was “disappointing” that over a third of major lenders were still not offering six-month product transfer windows.

Kerr continued: “We’ve been promoting the ability to lock in a deal six months ahead as a means of motivating homeowners to start their remortgage search asap rather than taking a “wait and see” approach.

“The current 15-year high mortgage rates mean a lot of homeowners fear the worst and are putting off checking their rate and acting early. The risk in doing so is that struggling borrowers miss out on the most affordable rates.”

She added that when rates were fluctuating, struggling homeowners could “really benefit” from locking in a rate six months in advance and “keeping it under review”.

“Most importantly, by locking in a rate six months before, homeowners avoid the financially crippling risk of defaulting on to their lender’s standard variable rate.

“The staggering standard variable rates (SVR) we are seeing from some lenders at the moment – up to 9.73 per cent – is nothing short of daylight robbery. It’s time the government reviewed how the Charter is being implemented and look at the punitive SVR rates lenders are charging,” Kerr noted.

Variance in PT windows not in the spirit of the Charter

Brokers have said that whilst the difference in product transfer windows is technically within the Mortgage Charter wording it is not in the spirit of the Charter.

They added that it could leave customers worse off as they could end up paying higher mortgage rates.

Figures from Moneyfacts six months ago show that the average two-year fixed rate was 5.29 per cent and the average five-year fixed rate is 4.94 per cent. This ratcheted up to 5.34 per cent and 5.01 per cent respectively four months ago, and rose even further three months ago to 6.26 per cent and 5.87 per cent three months ago.

Justin Moy, managing director at EHF Mortgages, said that a three- or four-month window could “make quite a difference in rate if your only option is to stay with your current lender” and it would be great to see more lenders offering six months.

Stephen Perkins, managing director at Yellow Brick Mortgages, said the wording of the Mortgage Charter was “too vague and open to interpretation”, with most lenders keeping their current timeframes as it was within the wording so was “fair and adequate”.

He added that brokers could often secure a remortgage rate six months before product expiry this mean that they “cannot review all the available options the client will have at this time”.

Perkins continued that lenders offering shorter periods could be risking customer retention as many customers were talking to brokers six months beforehand, and if the existing lender’s rate was not “markedly better” when two months pass the client was likely to go elsewhere.

“As a broker, it would certainly be beneficial to review all the client’s options at that point, and then monitor rates after looking for reductions. I would continue to advise clients to speak to a broker six months before their deal ends to review their options,” he noted.

Longer PT windows could ‘increase level of uncertainty’

When asked what the hurdles were to extending product transfer windows, a lender source said that a key consideration would be around the teams in place to maintain service levels with customers.

They explained that a longer remortgage window may require more frequent contact with customers, leading to a higher volume of calls and enquiries.

There would also be extra administrative issues as the longer period could mean potentially more issues arising with the customer, and another issue was around funding and management of conversion to completion.

One high street lender source said that extending the product transfer window was a “simple parameter change” for them but this would vary by lender.

“The wider consideration is that longer product transfer windows also increase the level of uncertainty for lenders given the amount that can change over that period, and this can be expensive for lenders to manage,” they noted.

Tony Crane, founder of Crane Consulting, said that whilst the Charter was voluntary so it was uncertain if “there was any real teeth in it”, there could be a Consumer Duty element.

“Duty-wise I think the transfer period falls under fair value – and maybe customer support. If lender A offers a six month transfer option but lender B doesn’t you might expect lender B to be offering a lower rate – not as many benefits being provided.

“In that scenario the broker could either choose lender B and inform the borrower of the additional risk, or choose the higher rate offered by lender A. In some ways this is exactly the type of feature that the FCA might have imagined when they talked about competitive advantage being created through Duty.”

He added: “Ultimately if the broker doesn’t feel the lender is offering a service that suits the needs of the borrower and/or that the product isn’t providing fair value they have grounds not to recommend it.”

The FCA was contacted for comment.

An HM Treasury spokesperson said: “The brand new flexibilities created by our Mortgage Charter, covering 90 per cent of the mortgage market, are already helping people get through this difficult time.”

“Customers can lock into a new deal up to six months before their current deal ends, providing certainty over their future payments, and request a better like for like deal with their lender if one becomes available before their deal starts. The Charter also provides extra protections against repossessions and makes it easier to manage monthly repayments.”