But more than a week has passed and despite the falling pound and the Bank of England suggesting it will pump more money into the economy, we haven’t seen any signs of those predictions coming to fruition (yet). So what’s happening?

I’ve been told by Nationwide, Halifax and NatWest that it’s ‘business as usual.’ Similarly, several smaller mortgage lenders have been telling me the same thing.

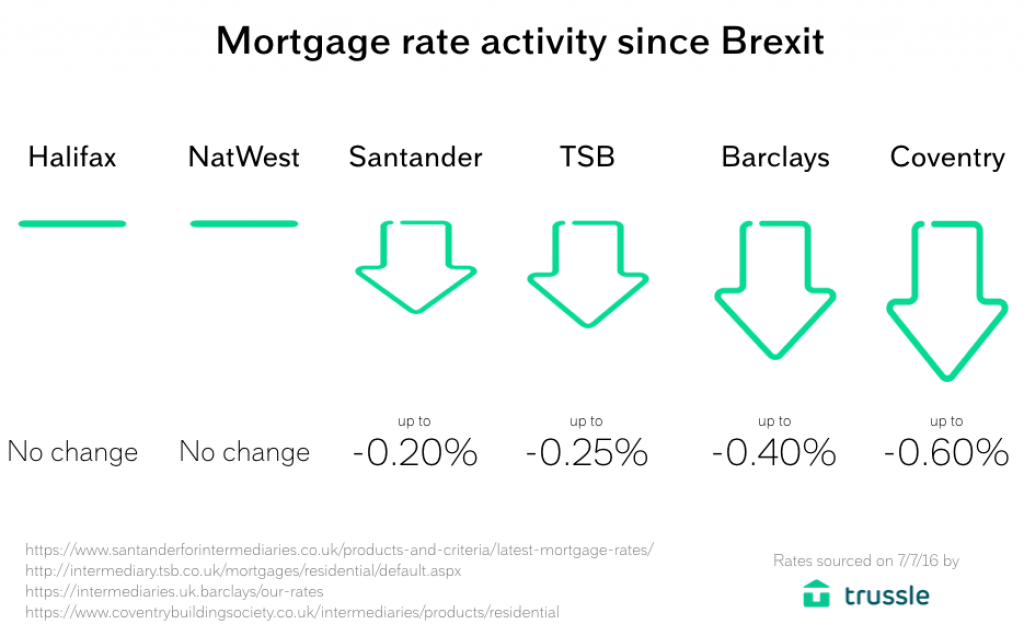

But while that’s true for some lenders, many actually have made changes that could save homeowners money.

Just this week Santander cut some of their product range by up to 0.2%, saving the average homeowner around £192 a year. Other lenders have lowered their rates too. Barclays cut rates across the board by up to 0.4% and TSB cut its buy-to-let range by up to 0.25%.

Longer-term five and 10 year fixed-rate mortgages are also currently at historically low levels. Barclays is offering a five-year fixed rate mortgage at 2.19%, while Santander is offering a competitive 10 year fixed rate at 2.94%. Coventry Building Society have also cut their 10 year fixed rate to just 2.39%, setting a new benchmark.

Banks have clearly remained competitive since Brexit and I expect them to continue doing so, at least in the near-term. The Bank of England is due to lower the amount of capital banks are required to hold in reserve which will free up an extra £150bn for lending. This is great news for those looking for a new mortgage.

A few weeks ago we conducted a national survey, finding that a staggering 69% of homeowners haven’t remortgaged since their initial fixed rate ended. It means that they’re paying their lender’s standard variable rate, which can mean much higher monthly payments.

Despite many of those respondents saying they hadn’t switched because they found mortgages confusing, now is the perfect time to get stuck in. New online services like Trussle have made finding and securing a mortgage a relatively simple process, so it’s worth having a look to see if they can take advantage of these historically low rates.

First time buyers should be using this opportunity to look for great value rates. While mortgage rates are low, concerns about a possible fall in house prices is likely to cause some homeowners (especially landlords) to sell up early. They may also be more likely to accept offers below asking price to ensure a sale. Buyers can get ahead of the game by securing a Mortgage in Principle to quickly assure estate agents that they’re serious buyers. Property moves fast, so they shouldn’t spend too long assessing their options.

Existing homeowners looking for long-term stability should be thinking about switching to a five or 10 year fixed rate while they’re so low. There’s a chance that rates could become even cheaper – the governor of the Bank of England hinted that the base rate could be cut further to just 0.25% in the coming weeks – but if they’re securing a mortgage that they can afford, the guarantee of long-term stability may be worth securing now.

At the very least homeowners should be moving away from standard variable rates as we’re almost certainly going to see instability over the coming months. The sooner those on standard variable rates switch, the sooner they can protect their family home against unforeseen rate increases.

Advisers should treat this period of uncertainty as an opportunity to go above and beyond client expectations. Homeowners and buyers alike are going to appreciate a straightforward and hassle-free service now more than ever.

This article was written by Ryan Tuff, senior adviser at online mortgage adviser Trussle