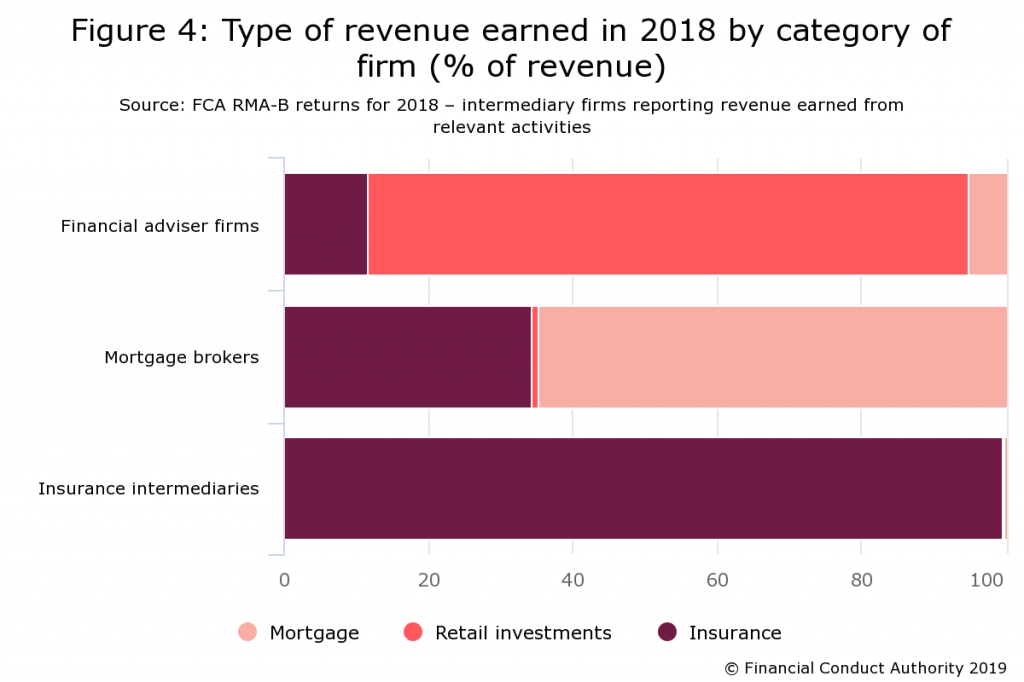

A third of income totalling £449m came from selling insurance products, but this share was more marked at larger firms where just 62 per cent of income came from mortgage mediation.

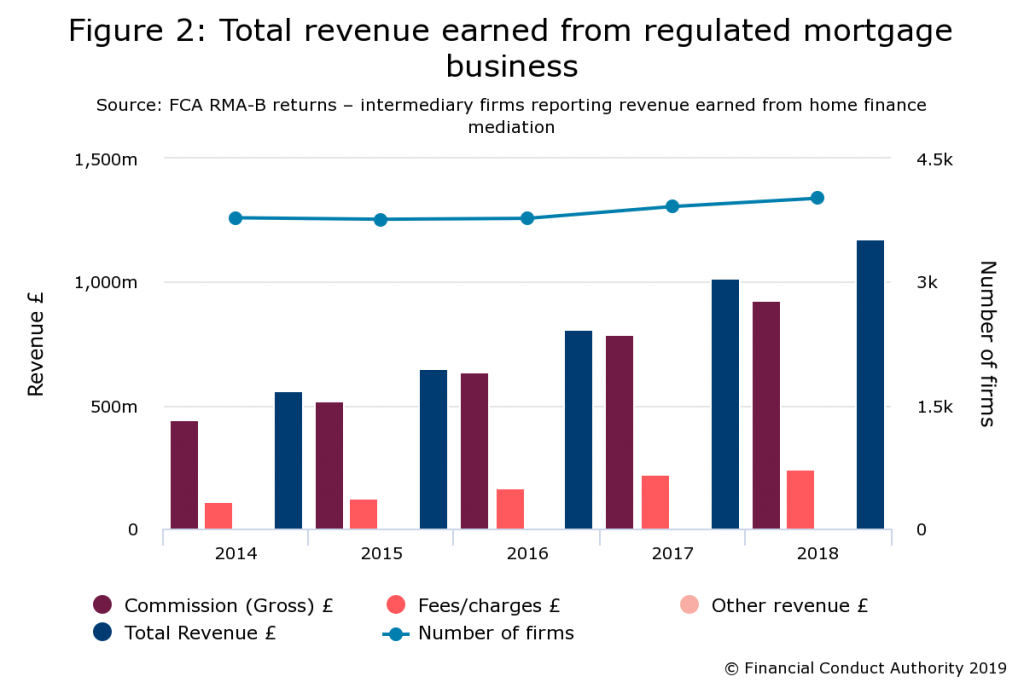

However, while revenue from advising on mortgages alone grew by 16 per cent to £1.18bn, brokers became more reliant on commission as their primary source of income.

Commission accounted for 79 per cent of revenue earned in 2018, up from 76 per cent in 2017.

Divided world

Data from the regulator also showed the mortgage advice world remains sharply divided in terms of size of firm and number of advisers and that those working at bigger firms earned more.

The total number of staff advising on mortgages last year was 14,052, up seven per cent on 2017, and they were employed by 4,018 firms, up from 3,917.

The small number of large firms with over 50 advisers account for 70 per cent of brokers, but almost 90 per cent of firms have five advisers or fewer.

Average revenue earned per adviser increased compared with 2017 for all firms except those in the 6-50 advisers band, where it fell by 14 per cent.

The average PII premium paid by mortgage brokers in 2018 was less than 1% of average regulated revenue.

And encouragingly, 96 per cent of all financial adviser firms reported making a profit with total pre-tax profits up to £872m from £698m in 2017, the FCA said.