Tag Result: rental price growth

Average rents reach record high in Q4 – Rightmove

Average rents both outside and including London rose to a new high in Q4 last year, data f...

Private rent prices jump by highest rate since 2016 – ONS

Private rental prices in the UK rose by 4.9 per cent in the year to March 2023.

GoCompare launches tool to find best areas for buy to let with Manchester in top position

Manchester has been ranked as the best place to rent out a house with an average yield of ...

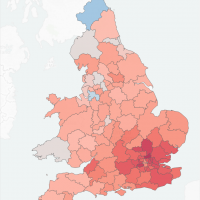

Rents up 2.4% as market continues to shift away from London – Your Move

According to Your Move’s latest England and Wales Buy-To-Let (BTL) Index, average rents ...

Luton tops UK buy-to-let index

Luton is the UK’s number one buy-to-let location, according to LendInvest’s revamped i...