Looking back at some historical data we can see first-time buyers are now borrowing over a longer term, using a higher percentage of their take home pay towards their mortgage payments, affordability has been getting more difficult, and the average age of the first-time buyer has risen.

Let’s take a look at this in more detail.

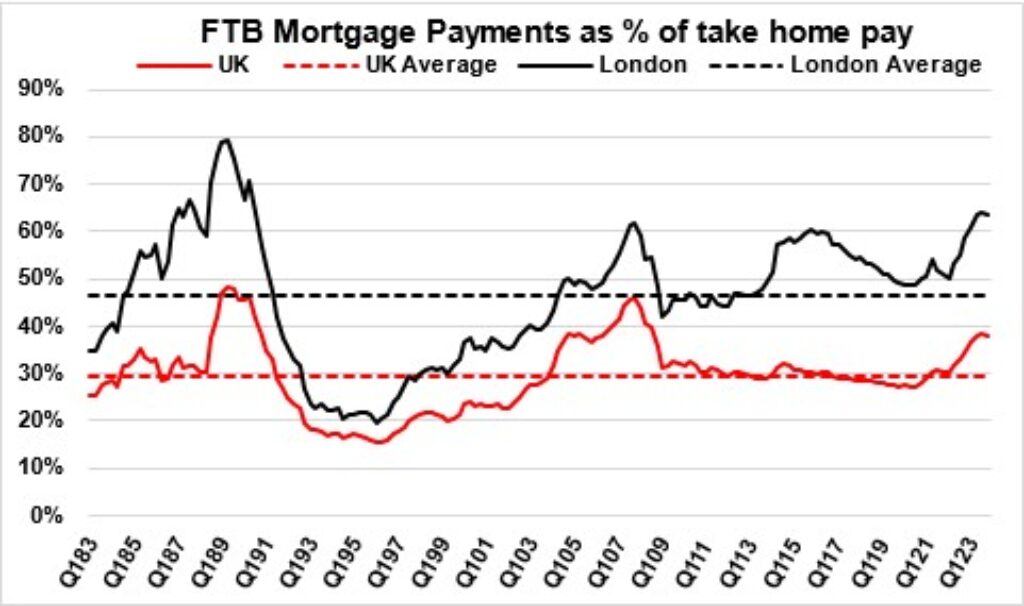

Below is an historic view of how much of a first-time buyer’s take home pay is used towards their mortgage. In 1983, the UK average percentage of first-time buyer income used towards their mortgage was 26.6 per cent and 36.6 per cent in London. Fast forward to 2003, and this decreased to 24.5 per cent in the UK but increased for London to 39.8 per cent.

Moving forward to 2023 this had significantly increased to 37.6 per cent for the UK and London had moved to 62.9 per cent.

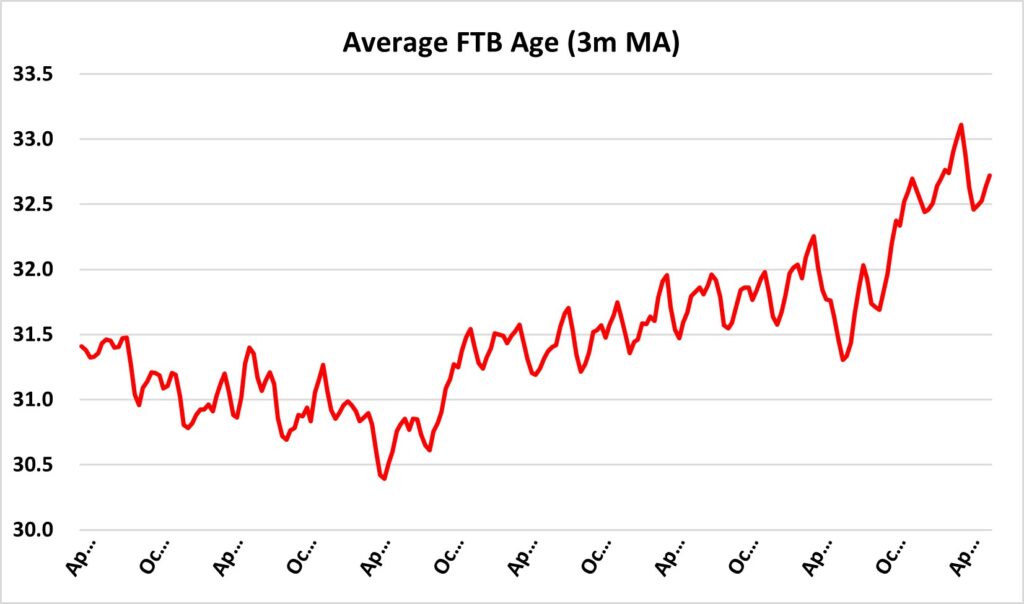

The chart below shows the average age of a first-time buyer also rising, and this now sits at about 33 for the UK.

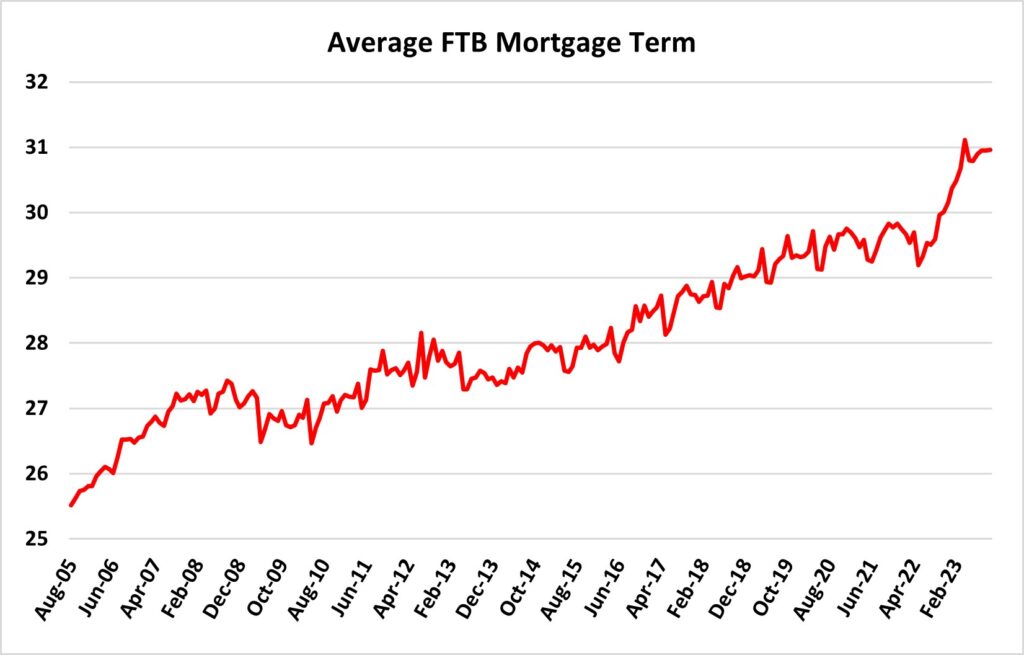

The average term for a first-time buyer mortgage now sits above 30 years. This has been steadily increasing and when compared to 2005, this was sitting at closer to 25 years. Quite often we see buyers have children before they buy a home. Not only does this make saving for a deposit harder while juggling the cost of childcare, but it also means the type of property they’re looking for needs to be larger or have outdoor space – which isn’t always readily available in the market.

Family support

Last year, Legal and General published an article saying if the “bank of family” was an actual bank, it would be a top 10 lender with the average gift/loan being over £25,000. The “bank of family” isn’t the only place that has been supporting new homeowners, and not every first-time buyer is in a position to be able to get support from family, but there has been support for lenders and from government they can turn to.

Lenders innovating to help first-time buyers

There has been innovation from lenders to support the first-time buyer market. We have seen lenders offering longer mortgage terms to help affordability. We have also seen 95 per cent deposit mortgages and even 100 per cent mortgages make an appearance in recent years. Additionally, there have also been discussions for longer-term fixed rate deals.

We have seen “Dutch style” mortgages making an entrance as well as a lender offering up to a 40-year fix.

Help from the government

The government has assisted first-time buyers with stamp duty incentives, the Help to Buy and First Homes schemes, shared ownership and Help to Buy/Lifetime ISAs. There is hope that there will be more incentives for them in the upcoming Spring Budget.

This has included rumours of 99 per cent mortgages and stamp duty changes, while others want the return of Help to Buy in some form. However, we will not know for sure until Chancellor Jeremy Hunt makes his announcement on 6 March.

Still, there’s hope for first-time buyers

Although it has been getting increasingly difficult, there is still hope for first-time buyers. Speaking to some of our economists, we expect this segment to remain strong and slightly increase as a percentage of the mortgage market in years to come.

| First-time buyer projections (Santander UK) | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 |

| Total gross advances (£bn) | 220 | 205 | 248 | 263 | 290 | 300 |

| First-time buyers (£bn) | 53 | 50 | 62 | 67 | 74 | 77 |

| First-time buyer share | 24.1 per cent | 24.4 per cent | 24.9 per cent | 25.4 per cent | 25.5 per cent | 25.6 per cent |

At this time, it is important to ensure we help first-time buyers navigate the mortgage journey and help increase their financial literacy. There will always be a market for new homeowners and the needs and requirements of these buyers will continue to evolve. It is important that as mortgage professionals we continue to innovate and find ways to support and guide our first-time buyers to ensure that they not only are able to get into their home, but also stay in their home.

We are reaching the peak of how long a mortgage term can run for without beginning to look at multigenerational loans. Considering the price of property and income levels, if we continue the same trajectory things will not get better. There is a lack of new properties being built and the demand for housing remains very high.

The rental market may seem like an option for those unable to buy, however the soaring costs of renting is also making the situation for first-time buyers to purchase their first homes increasingly difficult.

We need to build more homes, find ways to help affordability and help first-time buyers save for deposits.

We also need to see continued innovation from lenders and government alike, but if we do nothing, the situation will look worse in 2033 and 2043 and you could find yourself reading similar articles in years to come.