News

Mortgage broker revenue topped £1bn in 2016

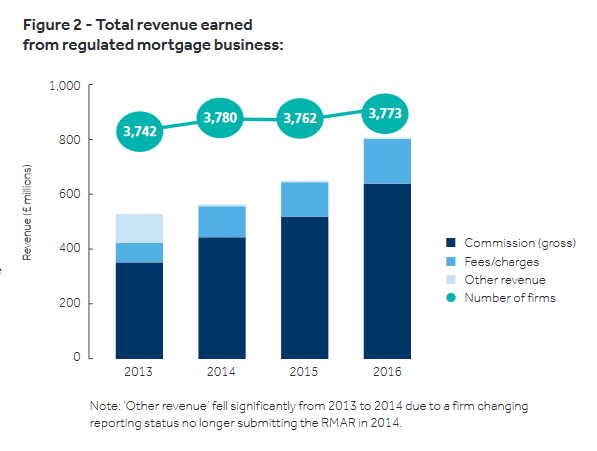

Growing market share and rising property prices mean mortgage broker revenue rose 24% in 2015-16 on the previous year, according to the Financial Conduct Authority (FCA).

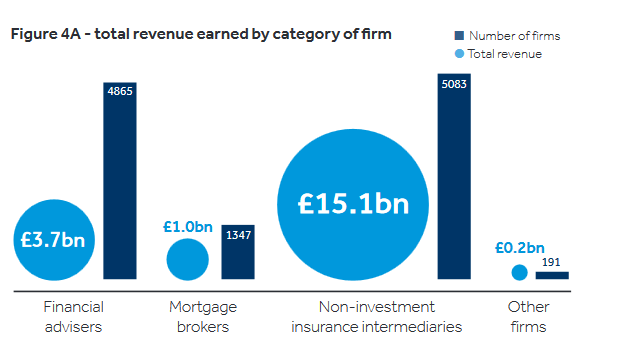

In total, brokers earned £1bn in 2015-16.

With revenues soaring 53% between 2013 and 2016, the regulator said this was particularly notable.

“We believe that this largely reflects an increase in the share of mortgage loans transacted via brokers as well as a general increase in the value of the mortgage market over the period,” it said.

The data showed that mortgage brokers were operating a diverse business model with 91% reporting they earned some revenue from non-investment insurance mediation.

Indeed, only 61% of revenue came from mortgage broking, with 38% coming from insurance business and 1% from investment advice.

The new-build energy advantage

Sponsored by Halifax Intermediaries

Shrinking direct to consumer market

According to FCA Product Sales Data, total regulated mortgage transactions carried out by intermediaries were 47% higher in 2016 than in 2013, whereas loans made direct from the provider to consumer were down by 20% over the same comparison period.

The FCA noted that the number of firms reporting revenue from mortgage mediation has remained fairly static at just under 3,800.

It said many of these are firms whose primary business is retail investments who also earn some revenue from mortgage mediation business.

Commission continues to be the main source of revenue for this type of business, accounting for approximately 80% of revenue earned in 2016.

Small firms dominate

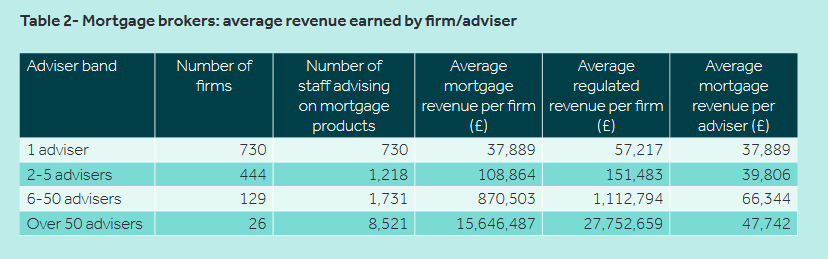

The FCA data also showed that of the firms categorised as mortgage brokers, a large number are small firms – 55% have only one member of advice staff and 88% have five or fewer advisers.

There are a small number of very large firms who account for a significant part of the market – the top 2% of firms (by adviser number) account for over two-thirds of the advisers and mortgage revenue earned.