Last week, the FCA confirmed that it was looking into the lifetime mortgages sector as some firms had been found to give “poor advice”, and was assessing advice quality through a sample of firms.

Robert Sinclair, chief executive of Association of Mortgage Intermediaries, said: “They’ve [FCA] been very specific in their Dear CEO Letters and in statements around the work they are doing on retirement.

“They are looking at this market and they are still uncomfortable with some of their findings.”

Sinclair said that the regulator had not been “specific at this point in time” but in the regulator’s view the “industry has not learned enough from the things that have happened previously”.

Kelly Melville-Kelly, head of risk, policy and compliance at the Equity Release Council, said that the council “works hard to raise standards across the entire industry, not just among its members”, with resources like its adviser guide and competency framework which are both in the public domain.

She added members can access further exclusive resources and the trade body offers bespoke support.

Melville-Kelly said that the ERC had produced a guide this year to set out a “consistent way of describing fees and charges using clear, simple and standardised language that is easy for customers to understand”.

“Our aim is to establish a set of standard definitions to help consumers to understand their options as they explore the equity release process with a regulated adviser,” she noted.

She continued that the council had developed a guide outlining best practices for communicating with customers at all stages of the process.

“We hope all firms, and the wider industry, take council guidance on board when they next revisit their approach, so it becomes the standard across the equity release market,” Melville-Kelly added.

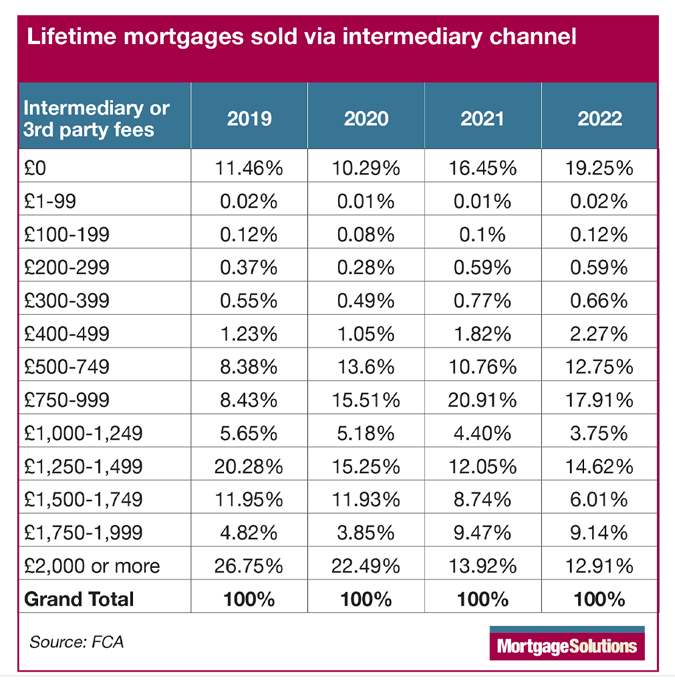

Nearly three quarters of fees over £500 in 2022

According to a Freedom of Information request sent to the FCA by this publication, around 77 per cent of lifetime mortgage broker fees were £500 or above in 2022, representing over a nine per cent fall over the past four years.

The trend of higher mortgage broker fees in the lifetime mortgage space has started to shift, going from 86.3 per cent in 2019 to 87.8 per cent in 2020 and then 80.3 per cent in 2021.

Around 19 per cent of lifetime mortgages sold through intermediaries did not charge a fee. This represents nearly an eight per cent growth of fee-free advice over the last four years, having increased from around 11.5 per cent in 2019.

The second largest tranche of fees was at the £750-to-£999-mark, accounting for around 17.9 per cent of lifetime mortgage broker fees.

This is down from around 20.9 per cent in the year before, but is up on 2019 and 2020 figures of 8.4 per cent and 13.6 per cent respectively.

This was followed by the £1,000 to £1,469 product fee bracket which made up around 14.6 per cent of mortgage broker fees charged in this sector.

This is an increase from around 12 per cent in 2021 but is down from around 20.3 per cent in 2019 and 15.3 per cent in 2020.

Sinclair said that regarding fees, the regulator would look at the outliers who were charging higher fees and identify why that is the case, noting that he believed that the FCA were “already doing that”.

“It’s no different to what they are doing in any market where they are operating. They’re looking at those firms that are charging significantly more than others and are looking for justification,” he said.

He noted that up to now that had been quite difficult to do but as firms should have undergone a fair value assessment as part of upcoming Consumer Duty regulation by April and the regulator can ask firms to show the workings behind that assessment.

Falling cost of advice ‘positive’ for consumers

Melville-Kelly said that the falling cost of advice was a “positive sign for consumers” who can “benefit from easier access to specialist advice when making decisions about their retirement”.

She noted that more than half of consumers were paying less than £1,000 for advice and nearly a fifth were accessing fee-free advice.

“Seeking regulated advice from a Council member is essential and we hope that lower costs, particularly in the current climate, will encourage more customers to explore the suitability of equity release.

“Today’s products are more flexible than ever before to suit a range of needs. By using a Council member, customers will benefit from the extra protections and safeguards our standards provide in addition to statutory regulation,” Melville-Kelly added.

More inconsistency in lifetime fees than ‘standard’

Tony Crane, founder of Crane Consulting, said that in the “standard market” fees were largely spread between £100 and £749, but in other markets like lifetime mortgages there was more “inconsistency”.

“One assumption I could make is that the tighter the spread of fees the more confident that part of the market is in understanding the value it creates.

“In terms of Consumer Duty and fair value that would bode well for standard mortgage brokers but could create some challenges justification-wise for the other markets,” he noted.

He added that the upward trend in those receiving fee-free advice was a “little surprising”.

“In my view, the value and need for advice has never been greater, therefore, while reducing consumer costs is clearly good news, the fact we’re giving it away for free…does raise some questions,” Crane added.

Some advice fees are still ‘too high’

Paul Saroya at Viva Retirement Solutions, said that some of the advice fees on the table were still too high, especially considering procuration fees are also paid.

He noted that the industry was moving away from percentage-based fees, which had previously been quite common, but brokers should ask themselves whether some of the highest fees were “really justified”.

“I would argue as initial loan sizes decrease, firms should be looking at their advice fees and asking themselves if the fees that clients are paying are fair. Is it right to replace percentage-based fees with high fixed advice fees?” Saroya said.

Overall, the fee trend was “absolutely going in the right direction”, he said, as generally fees were coming down but the sector “mustn’t become complacent”. He noted that nearly a quarter of fees were over £1,750, which is “simply too high”.

“Much more needs to be done from a self-regulation point of view. I, for one, would love to see the highest fees become completely extinct in our market.

“It has been said many times, but unless we self-regulate when it comes to charging advice fees, the decisions will be taken away from us, the industry, and will made by the FCA. The results of which we have seen painfully play out in the IFA market over recent years,” Saroya explained.

Lower fees could be non-specialists dabbling in space

Peter Huckerby, director at Lifetime Equity Release, said that there had been a “general downward pressure on charges”, which he said was “not too surprising” given the increased competition in a “buoyant sector”.

“At the lower end of the scale, what we see could be attributed, to some degree, to firms who may not advise on equity release as its core service, perhaps mortgage brokers who do an occasional cases,” he noted.

Huckerby said that procuration fees were higher on equity release than standard residential mortgages so some brokers may not charge an advice fee at all, or charge a standard advice fee.

“Mortgage brokers operate on much higher volumes of business than later life brokers, so they have different pressures and business models.

“On a side note, if this is the case, there is a concern that those advisers who are not specialists may not have a full understanding of the many nuances in the various plans when compared to a broker who is dedicated to equity release. Without having a bit more clarity on the sources of the data, it’s difficult to say for certain,” he added.

Rising costs and shrinking market could heighten broker fees

Huckerby said that the challenge facing brokers at the moment was the rising cost of living, which made it more expensive to maintain businesses and upcoming Consumer Duty regulation could also increase costs.

“This is nowhere more acute than the later life space as intermediaries in this area have additional challenges with a higher number of potentially vulnerable clients to deal with, which has been reflected in many firms’ professional indemnity cover costs in the past few months which have seen some sharp increases and less favourable terms,” he noted.

Huckerby continued that since the mini Budget the cost of acquiring cases has increased, and the smaller market size created challenges.

“We do not offer equity release to everyone who requests it, and we do advise many clients that alternatives are better. In addition to this, many clients who are good candidates have difficulty in getting equity release due to very strict property criteria, and other restrictions in the market.

“This all impacts a broker’s costs, and our business model is very different to a residential mortgage broker, who still has challenges. But they have a much larger market to work with and many repeat customers, which is not the norm with equity release,” he explained.

Huckerby said that total volume in the equity release market was down, leading some firms to let go of staff, which could lead to “shortages of access to qualified advice once the market regains confidence and volume of enquiries increase”.

“The current situation inevitably puts pressure on brokers to increase advice fees, and longer term when markets recover, it could lead to firms trying to recoup losses by charging more. However, like everyone else, I don’t have a crystal ball, so it’s hard to say for certain,” he added.

‘We need to be more secure in the value that we provide’

Paul Glynn, CEO of Air, said that later life lending was “in-depth specialist advice” and could take more time than other types of mortgage advice, often involving multiple meetings with older homeowners, their families and solicitors.

“There is also the cost of compliance, finance, marketing and all the support services that allow firms to operate safely in a regulated market,” he added.

Glynn said that Consumer Duty would place fees under the microscope and look at whether the “fee-charging structure constitutes fair value to the customer”.

“Nothing is set in stone and firms need to be comfortable that the service they provide reflects the income they receive. Speaking to advisers and knowing the difference that the right advice can make to a customer later life, I think as an industry, we need to be more secure in the value that we provide,” he added.